- USDT dominates with a 59.02% market share, but USD1 is emerging as a strong multi-chain challenger on Solana.

- The global stablecoin market has surpassed $284 billion, showcasing resilience and growth despite past market shocks.

- USD1’s integration with Solana DeFi platforms like Kamino and Raydium boosts liquidity and strengthens Solana’s $12B stablecoin market.

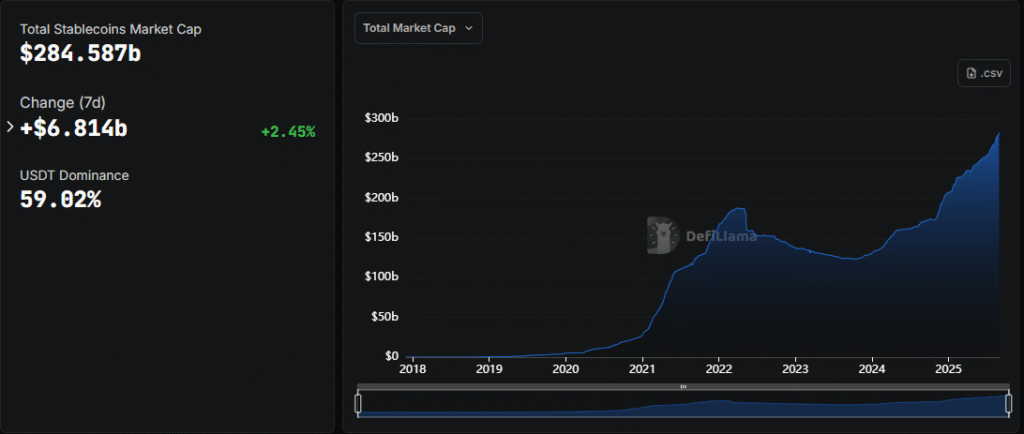

The global stablecoin market has surpassed $284 billion, marking a significant milestone for digital assets. Tether (USDT) is still in the lead with 59.02 percent of the market. USDT’s continued importance in trading, settlement, and liquidity on both centralized and decentralized platforms is demonstrated by its prominent position.

The market saw a $6.81 billion increase in the last week, which is indicative of rising demand for reliable digital assets. USDT has maintained its position as the main link between the fiat and cryptocurrency markets in spite of recent volatility. Its function enhances trust in stablecoins as essential tools in international digital finance.

The charted trajectory since 2018 shows steep growth driven by DeFi adoption and dollar-backed demand during economic uncertainty. Although contractions occurred after events like Terra’s collapse, recovery has proven resilient. This long-term trend reinforces the relevance of stablecoins as essential infrastructure within digital economies.

USD1 Expands to Solana

World Liberty Financial has launched its USD1 stablecoin on Solana, further strengthening its multi-chain presence. The token, pegged 1:1 with the U.S. dollar, is backed by Treasuries and cash equivalents. This move reflects confidence in Solana’s high throughput and low-cost infrastructure.

USD1 integration has begun on major Solana DeFi platforms such as Kamino, Raydium, and Bonk.fun. These early connections ensure liquidity and utility from the outset. Analysts argue that additional liquidity from USD1 could reinforce lending and settlement activity across Solana’s ecosystem.

The stablecoin has already been deployed on Ethereum, BNB Chain, and TRON, where it achieved notable traction. Exchanges including Binance and Bullish adopted USD1 in separate investment deals. Its current circulating supply stands near $2.5 billion, with most concentrated on BNB Chain.

Market Growth and Outlook

The stablecoin market continues to expand despite regulatory pressures and systemic risks. The ongoing rise beyond $280 billion emphasizes their entrenched role in modern digital finance. Moreover, growth underscores how stablecoins underpin payments, remittances, and DeFi transactions worldwide.

USDT remains the dominant player, but USD1 is carving a competitive position through multi-chain strategies. The entry into Solana’s $12 billion stablecoin market strengthens its momentum. Consequently, Solana gains a reliable asset that supports broader financial adoption and interoperability.

Overall, the trajectory of stablecoins reflects both resilience and expansion. Their market integration continues to deepen across protocols, exchanges, and blockchains. The combination of liquidity, speed, and dollar-pegged security cements their function as foundational instruments in the digital economy.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.