Crypto enthusiasts are buzzing about VeChain ($VET), an enterprise-focused blockchain, following a compelling analysis by CryptoBusy on X.

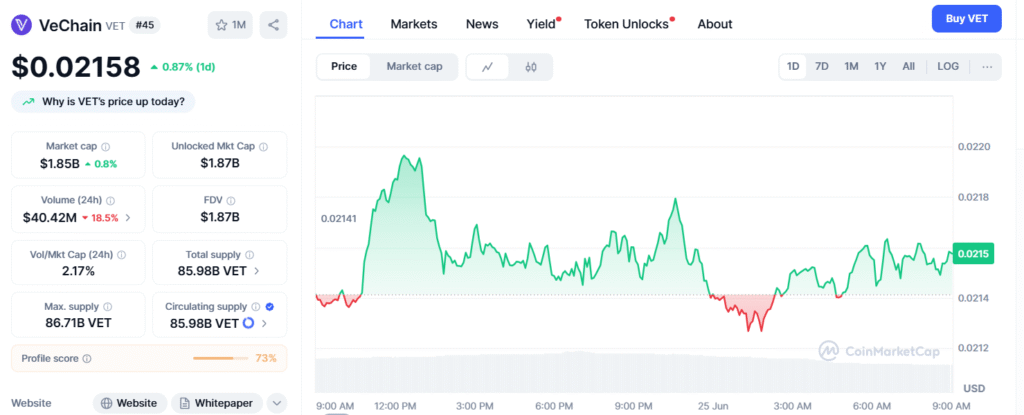

The platform recently highlighted a double bottom pattern forming on $VET’s chart, a classic technical signal indicating a potential reversal from its prior downtrend. This pattern, marked by two distinct lows (“Bottom 1” and “Bottom 2”) and supported by a key historical support level, suggests that $VET could be on the cusp of a significant upward move if it breaks the $0.03 resistance level.

The timing couldn’t be better, with VeChain’s Galactica mainnet upgrade slated for July 1, 2025. This upgrade, combined with real-world adoption through partnerships with giants like BMW, Walmart China, and LVMH, underscores the project’s growing utility. VeChain’s focus on sustainability data tracking and supply chain transparency has solidified its position as a leader in enterprise blockchain solutions, as noted on vechain.org. The upcoming upgrade is expected to enhance its ecosystem, including cross-chain capabilities and staking incentives, potentially driving further adoption.

On-chain activity is rising, with social sentiment on X showing a mix of optimism and caution. Analysts suggest that post-upgrade momentum could flip the script, especially with enterprise traction and the Renaissance narrative gaining steam. However, the current technical rating from TradingView indicates a “strong sell” signal short-term, urging investors to monitor price action closely.

For those seeking undervalued Layer 1 blockchains with real-world impact, $VET presents a compelling case. As the upgrade approaches, all eyes are on whether VeChain can reclaim $0.03 and ignite a bullish trend.

As always, DYOR and proceed with caution (NFA). Stay tuned to CoinCryptoNewz for the latest updates on this evolving story!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.