- VeChain’s bubble risk metric at 0.82 indicates a high chance of 30-50% price correction, per BIS historical patterns.

- Multiple bubble peaks since 2018, driven by speculative retail trading, as per 2022 Journal of Financial Economics study.

- December 2025 Renaissance upgrades to VTHO and staking aim to reduce inflation, echoing 2008 Fed bubble countermeasures.

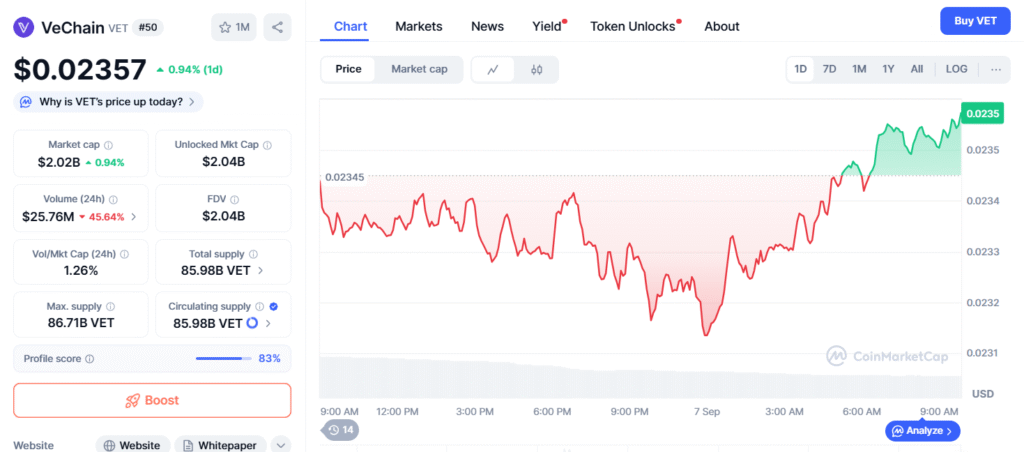

In the volatile world of cryptocurrencies, VeChain (VET) has once again captured the spotlight with its recurring bubble risks.

A recent chart from Into The Cryptoverse, shared by ITC_Crypto on X, highlights VET’s turbulent journey since 2018. The data reveals multiple short-term bubble episodes, with notable peaks in late 2021 and mid-2025. This pattern underscores potential overvaluation fueled by speculative trading, a phenomenon echoed in a 2022 study from the Journal of Financial Economics. The research links crypto market volatility directly to retail investor behavior, where hype-driven surges often lead to sharp corrections.

As of September 7, 2025, VET’s bubble risk metric stands at a concerning 0.82, signaling a high likelihood of an impending price adjustment. Historical precedents from the Bank for International Settlements (BIS) reports on crypto bubbles show that assets experiencing rapid price escalations frequently endure 30-50% drops within months. For VeChain, this isn’t just abstract theory—it’s a repeat of cycles seen in 2018 and 2021, where euphoria gave way to market resets.

Investors drawn to VET’s enterprise blockchain solutions, like supply chain tracking for giants such as Walmart China and BMW, must weigh these risks against the project’s real-world utility.Yet, hope glimmers on the horizon with the upcoming VeChain Renaissance upgrades slated for December 2025. These enhancements promise to overhaul VTHO generation and staking models, aiming to curb inflation and foster long-term stability. By adjusting supply dynamics, VeChain could mitigate bubble formations, aligning with economic principles from a 2008 Federal Reserve study on asset bubbles. The study emphasizes how targeted supply interventions can deflate speculative pressures, potentially positioning VET for sustainable growth.

For web3 enthusiasts, this moment is pivotal. While the bubble risk urges caution—perhaps diversifying portfolios or setting stop-losses—the Renaissance upgrades could redefine VeChain’s trajectory. In a market where DeFi and NFTs dominate headlines, VET’s focus on tangible blockchain applications remains a compelling narrative.

As we approach the end of 2025, monitoring on-chain metrics and community sentiment will be key. Will VeChain burst another bubble, or emerge stronger? The crypto space watches closely.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.