The cryptocurrency market is witnessing a fascinating shift, with XRP stealing the spotlight as sentiment…

Whales Buy 900M XRP as Ripple Ups Circle Bid to $20 Billion

- Whales acquired 900 million XRP, signaling strong institutional confidence.

- Ripple’s $20B Circle bid could reshape its financial services approach.

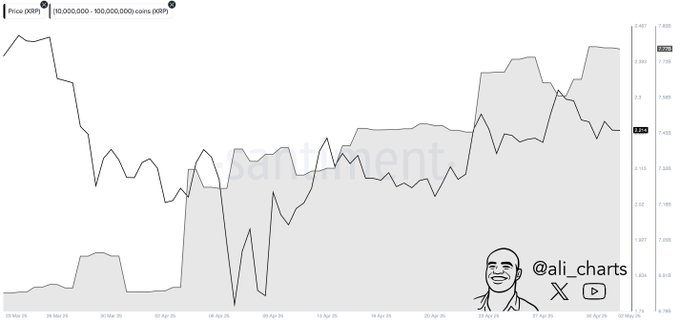

Whales have purchased approximately 900 million XRP in just one month. The accumulation began in late March and intensified through April.

According to on-chain analyst Ali Martinez, this surge reflects a sharp increase in investor interest, particularly among large holders. These whales are believed to be anticipating favorable market developments or a potential rally.

XRP’s price reacted with upward movements after each wave of whale buying. Analysts tracking the activity observed a clear link between large wallet movements and price action. As more tokens shifted into whale wallets, XRP saw periodic gains, further fueling speculation about future performance.

Ripple’s $20 Billion Circle Acquisition Talks Advance

Ripple has reportedly increased its offer to acquire Circle to $20 billion, up from an earlier $5 billion proposal. The news came from sources familiar with the negotiations, who indicated that discussions are nearing a conclusion. Ripple’s CEO, Brad Garlinghouse, is leading the push, signaling a strategic expansion beyond XRP and blockchain payments.

Ripple’s Chief Technology Officer, David Schwartz, responded to the developments with a tweet referencing the bid. His remark, “$6 billion, but that’s our final offer,” was a lighthearted acknowledgment of the rising valuation. It also hinted at confidence within Ripple about the potential outcome.

If finalized, the deal would mark a major strategic shift for Ripple. Analysts say it could position Ripple as a broader financial institution, integrating infrastructure, stablecoin issuance, and cross-border settlement solutions. However, neither Ripple nor Circle has released an official statement.

XRP Price Consolidates as Chart Patterns Tighten

XRP currently trades around $2.22 and has formed a symmetrical triangle pattern. The price sits between support at $2.12 and resistance at $2.33. Technical indicators suggest a breakout may occur soon as the range tightens.

Bollinger Bands on the chart have narrowed, signaling low volatility and a buildup toward a significant move. If XRP breaks above $2.33, analysts see potential for a rally toward $2.45. A failure to break resistance could trigger a pullback toward $2.12, with $2.05 as a critical support zone.

Traders are watching closely as XRP approaches the apex of the triangle. Combined with ongoing whale accumulation and Ripple’s corporate activity, the technical setup could lead to sharp price movements. The coming days may offer clearer signals about XRP’s next trend direction.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.