- Over 800,000 LINK bought during the dip boosted liquidity and helped secure support above $20.

- Price surged to $29.47 in early 2025 before corrections, highlighting Chainlink’s cyclical trading pattern.

- Resilient Out With LINK at $21.80, whale buying and oracle adoption could sustain momentum despite broader crypto market swings.

Large holders accumulated more than 800,000 Chainlink (LINK) during a recent dip, supporting a rebound above the $20 mark. Whale activity has helped stabilize LINK after volatile swings, signaling renewed confidence in its market position. The token now trades near $21.80, well above its cycle low of $7.05.

Whale Accumulation Supports Market

Whales increased their holdings as LINK prices fell, reinforcing the strategy of accumulating during discounted phases. Their moves added liquidity and reduced selling pressure, which often strengthens short-term price support. This accumulation indicates significant market interest despite broader volatility across digital assets.

Whales hold a strong influence because their large trades affect liquidity and directional momentum. Their recent buying aligns with historical patterns where major players accumulate at lower price levels. This trend has contributed to LINK’s recent rebound above critical thresholds.

Moreover, whale-driven accumulation creates indirect momentum as smaller market participants follow their activity. Such behavior can reinforce stability and encourage renewed confidence in the asset. As a result, LINK regained ground quickly after recent declines.

LINK Price Action Since 2023

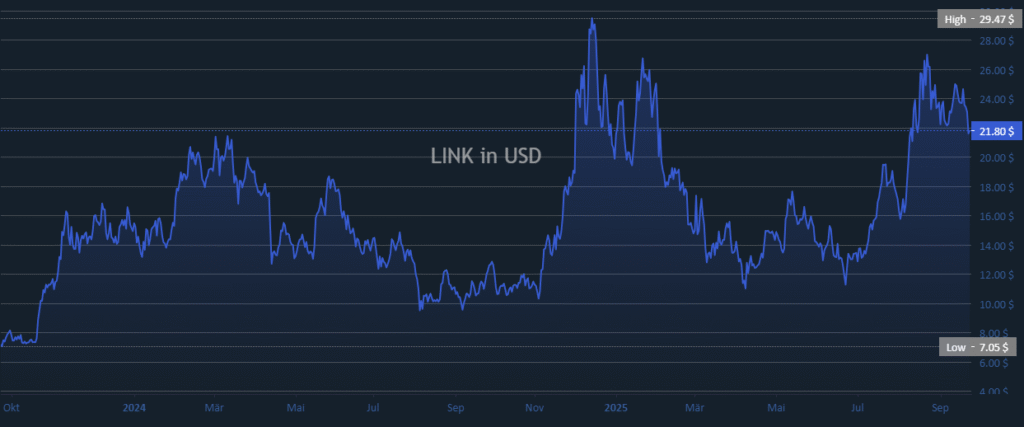

The chart shows LINK trading with sharp rallies and corrections between late 2023 and September 2025. Early 2024 marked strong gains before a pullback that extended through mid-year. Prices declined, reflecting shifting sentiment and reduced appetite for risk.

Source: blockchaincenter

In late 2024, LINK began a significant recovery, leading into a strong surge in early 2025. The price reached a peak near $29.47 before another correction followed. The decline dragged LINK back toward mid-teen levels before stabilizing.

Currently, LINK trades above $21, showing resilience after earlier swings. The recent rebound underscores stronger support levels compared to previous downturns. However, sustaining momentum depends on broader crypto market conditions and ongoing demand for Chainlink technology.

Outlook for LINK

Chainlink’s price reflects the cyclical nature of digital assets, shaped by adoption trends and market liquidity. Whale participation remains a central factor in supporting stability during volatile conditions. Their actions provide both confidence and directional cues for the wider market.

LINK’s current consolidation near $21 suggests it may hold gains if buying momentum continues. Broader adoption of Chainlink’s oracle solutions could strengthen demand further. Additionally, continued whale accumulation may act as a buffer against deeper corrections.

The trajectory of LINK will depend on both market sentiment and global digital asset conditions. For now, it trades comfortably above its cycle lows. The token shows resilience, but future moves will depend on sustained accumulation and favorable conditions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.