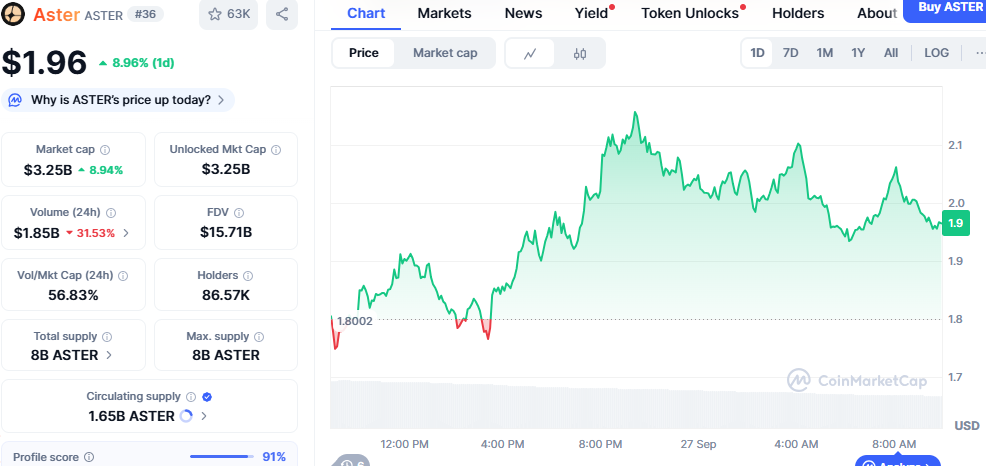

- $ASTER flipped $1.94 into support, signaling a bullish bias with potential continuation toward $2.20–$2.50.

- Daily volume fell 30%, yet liquidity remains strong at 56%, keeping upward momentum intact despite reduced activity.

- With only 20% of tokens circulating, future unlocks may shape long-term dynamics while short-term sentiment stays constructive.

Aster continued its upward momentum after reclaiming $1.94 as support. The token traded at $1.96, reflecting strong market confidence. The move above earlier resistance highlights a constructive trend with immediate upside potential.

Price activity shows a decisive recovery from the $1.80 level. The token established higher lows after a correction, and buyers regained control. Technical structure indicates an upward bias as long as support remains firm.

The market outlook points to higher resistance levels. $2.19 acts as the first barrier, and $2.50 remains the major target. Any break below $1.62 would reverse sentiment.

Trading Activity and Liquidity

Daily trading activity reached $1.85 billion, but volume slipped by more than 30% compared with the previous session. This decline shows reduced participation despite recent gains. However, the liquidity ratio of over 56% remains healthy for continued trading strength.

Source: Coinmarketcap

Market capitalization now stands at $3.25 billion, reflecting an 8.94% increase in value. Circulating supply is 1.65 billion ASTER, out of a total of 8 billion. This means most tokens remain locked, creating future supply dynamics to consider.

The active trading range extended to $2.10 before retreating. Rejection at this level established resistance, but consolidation above $1.94 maintains momentum. Sustained buying interest remains critical for another attempt higher.

Holders and Long-Term Context

Holder count rose to 86,570, showing gradual adoption across the network. Concentrated ownership can lead to volatility and rapid shifts in sentiment. Short-term rallies may therefore intensify before consolidation occurs.

Token supply remains a longer-term factor. With only 20% of tokens in circulation, unlocking phases could pressure future price levels. Still, the unlocked market cap aligns with current valuations.

Overall sentiment remains constructive. As long as $1.94 holds, the path toward $2.20 and $2.50 stays intact. Breaking resistance could establish fresh highs.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.