- WLFI faces a potential correction as the price nears overbought levels, according to technical indicators.

- World Liberty Financial’s $10 million buyback supports WLFI but risks a short-term price pullback.

- WLFI’s RSI stands at 58.45, signaling possible overbought conditions that may lead to price correction.

World Liberty Financial’s token WLFI has recently shifted out of a multi-week consolidation range, drawing attention from traders. The token has gained momentum by forming a consistent pattern of higher lows, signaling a possible uptrend.

Technical Indicators Signal Overbought Conditions

Currently, WLFI is trading at $0.1584, reflecting a slight drop of -1.19%. The Bollinger Bands, which track volatility, indicate that the price is testing the upper band at $0.1691. This suggests that WLFI is nearing an overbought condition, which often precedes a pullback.

In addition, the Relative Strength Index (RSI) stands at 58.45, which is not extreme but shows that the market could be approaching overbought territory. Although the RSI does not signal an immediate reversal, traders should remain cautious as WLFI moves closer to overbought levels.

Buyback Program Supports Price but Risks Short-Term Correction

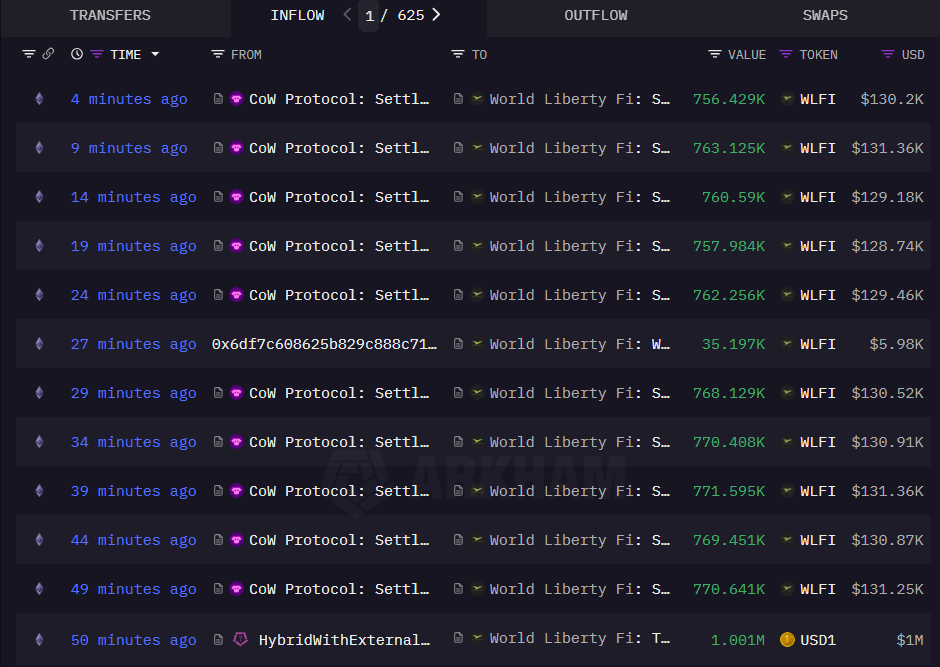

Despite the potential for a correction, WLFI’s price is being bolstered by a strong buyback initiative from World Liberty Financial. The company has spent around $10 million to repurchase 59 million WLFI tokens in just six hours, according to Arkham Intelligence.

This aggressive buyback program has contributed to the asset’s upward momentum. Additionally, an automated buy program launched by World Liberty’s strategic reserve wallet has already purchased $1.2 million worth of WLFI on CowSwap.

The automated system executes purchases at a rate of approximately $131,000 every five minutes, maintaining constant buying pressure on the token. As these buyback efforts continue, they may provide a stabilizing effect for WLFI’s price.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.