- XLM trades at $0.2523, holding above key weekly support at $0.2277 amid low volatility.

- BENJI fund has over $581M of its $824M TVL on Stellar, showing institutional preference.

- Resistance for XLM stands near $0.2657 as market watchers expect extended consolidation.

Stellar Lumens (XLM) remains in a cautious phase as its price shows limited momentum, hovering near key technical levels. At the same time, Stellar’s growing role in real-world asset tokenization, particularly through Franklin Templeton’s BENJI fund, is attracting institutional attention.

XLM Price Holds Support as Market Consolidates

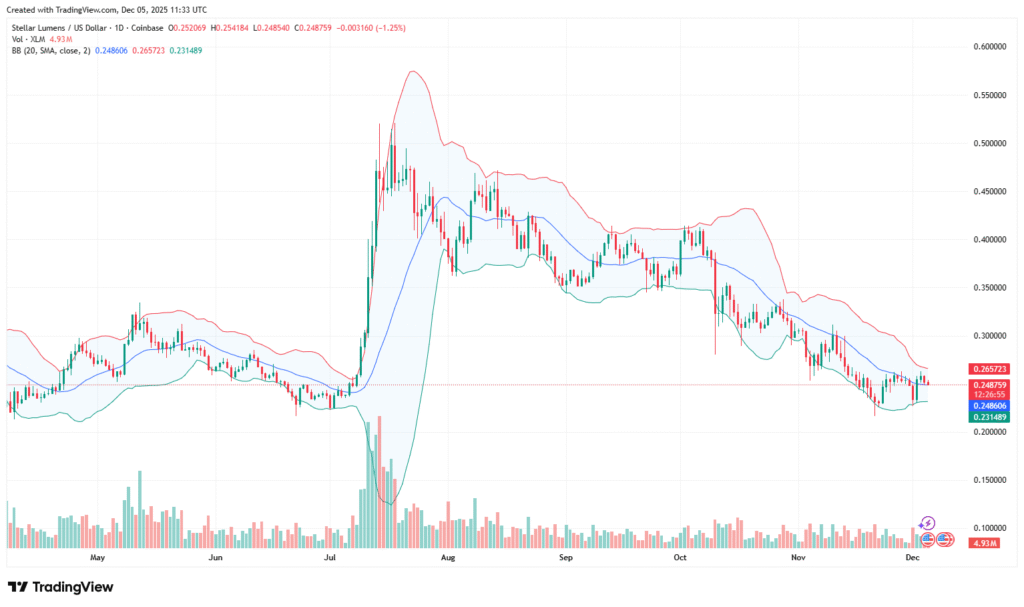

Stellar Lumens (XLM) is currently trading at $0.2523 as of December 5, 2025. The price has shown minor declines recently, including a 1.25% drop in the last 24 hours. TradingView data shows the token remains above key weekly support at $0.2277. This support level has held through past downturns, suggesting a strong buyer presence in the area.

Bollinger Bands on the daily chart indicate reduced volatility, with price action hovering around the middle band (20-day simple moving average), which is now $0.2486. Narrowing bands often suggest that a breakout or sharper movement could follow. Current resistance is noted at $0.2657, a level that XLM has struggled to break in recent sessions.

Some analysts believe the market is in an accumulation phase, where investors are gradually building positions. According to analyst TheBlockBull, “A shakeout may occur as rate-cut expectations attract retail traders, giving room for market makers to reset positions.”

Stellar Gains Institutional Trust Through BENJI Fund Allocation

The Stellar blockchain continues to show strong traction in real-world asset tokenization. According to Tokenicer, Franklin Templeton’s BENJI fund holds over $581 million of its $824 million total value locked (TVL) on the Stellar network. This represents more than 70% of its total tokenized assets across eight blockchain platforms.

Base, the second-highest network by TVL in the BENJI fund, holds under 10%, which further reflects the concentration of trust in Stellar. Analysts monitoring tokenization trends see this as evidence that institutions are beginning to favor Stellar’s infrastructure for compliant and scalable financial products.

Tokenicer stated, “Stellar is clearly leading real-world asset tokenization,” and noted the network’s suitability for institutional-grade applications. Stellar’s speed, low fees, and regulatory-ready framework are among the reasons cited for this adoption.

Market Outlook Remains Mixed

While Stellar’s institutional growth continues, short-term price action for XLM remains neutral to bearish. Some market participants are anticipating more downside or extended sideways movement.

However, with long-term support intact and ongoing institutional usage, market sentiment could shift depending on macroeconomic developments and risk appetite.

Analysts expect the consolidation phase to last several weeks. If XLM holds above support levels and breaks through resistance, price action may turn bullish.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.