- Bearish engulfing candle on XRP/USD 4-hour chart signals potential reversal.

- FOMC meeting impacts crypto prices, with XRP dropping amid rate hike speculation.

- Recent 100% rally suggests resilience, hinting at possible buying opportunities.

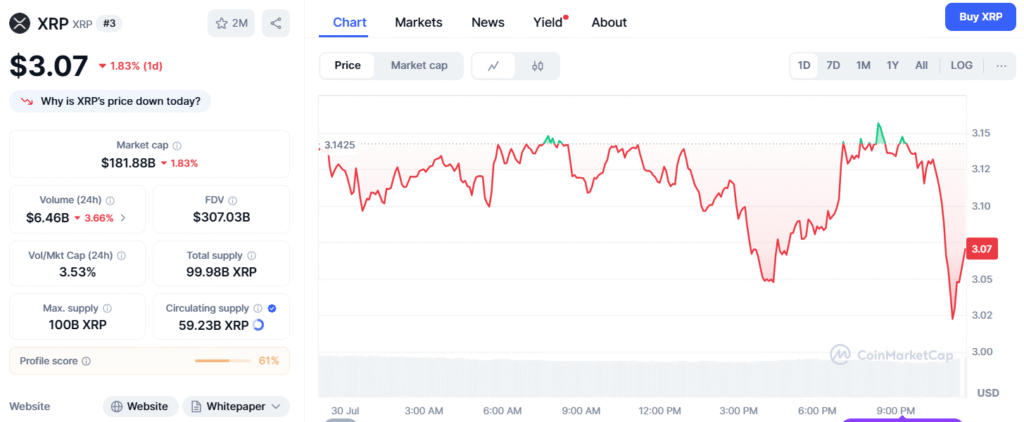

The cryptocurrency market is buzzing with reactions to a notable shift in XRP’s price trajectory.

Crypto analyst EGRAG CRYPTO (@egragcrypto) highlighted a bearish engulfing candle pattern on XRP/USD’s 4-hour chart, signaling a potential reversal following a recent uptrend. This pattern, characterized by a larger bearish candle overshadowing a smaller bullish one, aligns with Investopedia’s definition of a strong bearish indicator, particularly when accompanied by high trading volume—a trend observed amid recent market volatility.

The analyst attributes this downturn to the Federal Open Market Committee (FOMC) meeting, where the U.S. Federal Reserve’s monetary policy decisions, including potential federal funds rate hikes, have historically impacted crypto prices. CoinDesk reports a 4.5% Bitcoin drop post-FOMC, underscoring the market’s sensitivity to such shifts.

Despite the bearish signal, XRP’s context offers a nuanced picture. TradingView data reveals a 100% rally in recent weeks, suggesting robust bullish momentum that could challenge a prolonged decline. The current price hovers around $3.0479, with technical indicators like MACD and RSI showing mixed signals, as seen in the chart screenshots. Some X users speculate this dip might be a short-term pullback, with support levels potentially attracting buyers, while others express frustration or plan to sell. The FOMC’s influence, detailed on federalreserve.gov, stems from its control over short-term interest rates, which affect investor behavior and asset prices, including cryptocurrencies.

Looking ahead, traders are advised to monitor key support levels and combine the bearish engulfing pattern with additional indicators like moving averages or volume analysis for confirmation, as recommended by technical analysis experts. Whether this marks a temporary setback or a trend reversal remains uncertain, but the crypto community is keenly watching XRP’s next move in this post-FOMC landscape.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.