Cryptocurrency enthusiasts are buzzing about a potential price dip for $XRP, the native token of the Ripple network.

According to a recent analysis by @ali_charts on X, if $XRP falls below the critical $3.15 support level, it could pull back to $3, presenting a solid “buy-the-dip” opportunity for investors.

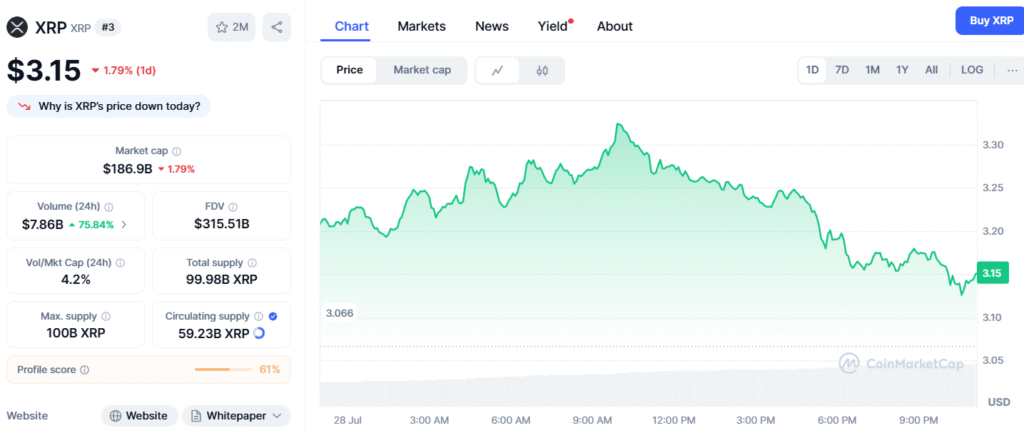

This insight comes amid real-time data from CoinMarketCap, which shows $XRP trading at $3.15 with an impressive 24-hour trading volume of $7.6 billion, reflecting heightened market activity. The technical analysis aligns with established trading principles, where support levels—identified by historical price floors—signal potential buying zones when breached.

However, $XRP’s market behavior is also influenced by external factors, notably the ongoing legal uncertainty from the 2020 SEC lawsuit, which classified the token as a security. This regulatory overhang continues to impact investor sentiment, making technical signals like those from @ali_charts particularly valuable for navigating the volatility.

The “buy-the-dip” strategy, as outlined by cryptocurrencyfacts.com, has proven effective for top coins like $XRP during bull markets, with historical precedents showing significant recoveries. The strategy involves averaging in as prices decline or buying after stabilization, though it warns against impulsive moves during sharp crashes. Given $XRP’s current upward trend and strong community support, a dip to $3 could indeed attract bargain hunters, provided they monitor market conditions closely.

Investors should also consider broader market trends and the potential for a breakout, as suggested by Barchart.com’s technical trading rules, which emphasize support and resistance levels. While the short-term outlook is cautiously optimistic, the interplay of technicals and legal developments will be key.

For now, @ali_charts’ analysis offers a data-driven starting point for those looking to capitalize on $XRP’s next move.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.