- XRP’s growing FUD indicates retail traders’ impatience, often a buy signal.

- Higher bearish sentiment in XRP reflects possible market reversal signs.

- XRP’s recent FUD surge mirrors patterns seen before price rallies.

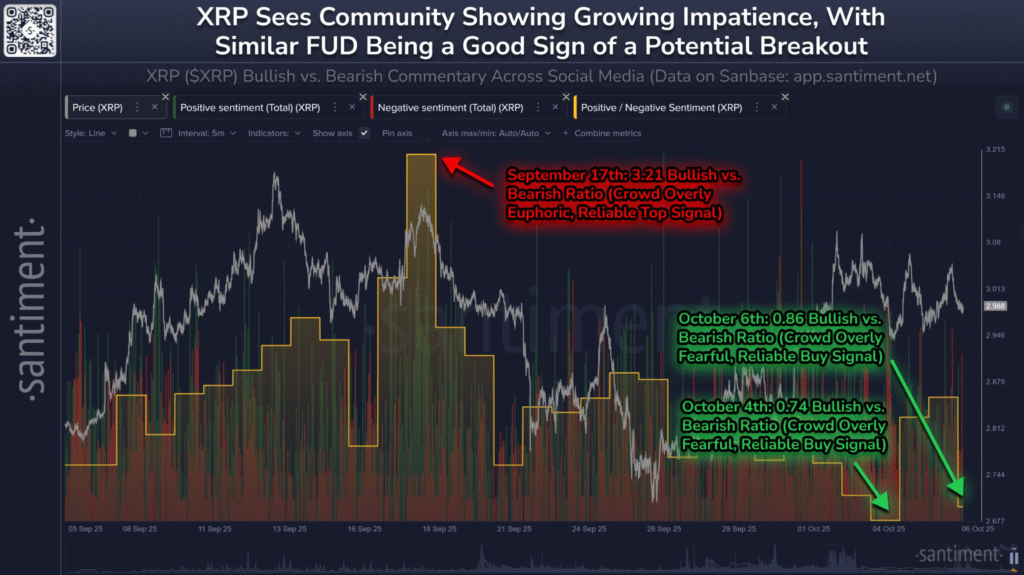

Ripple (XRP) has been experiencing an increase in retail fear, uncertainty, and doubt (FUD), particularly over the last few days. This rising FUD indicates growing impatience within the community, signaling potential shifts in the market.

Retail sentiment analysis, based on social media commentary, indicates that for two of the last three days, the number of negative comments exceeded the number of positive ones. This bearish sentiment often presents a promising buy signal for traders, as markets tend to move opposite to retail expectations.

FUD as a Sign of Potential XRP Reversal

On October 6th, the bullish-to-bearish ratio for XRP dropped significantly, reflecting the growing pessimism among retail investors. This shift is similar to previous periods where retail FUD became a reliable buy signal.

As sentiment turned overly fearful, XRP’s potential for an upward price movement became more apparent. According to Santiment data, the bearish trend follows the previous month’s pattern, where rising FUD was seen as an indicator of a price reversal.

Santiment’s data highlights the inverse relationship between retail sentiment and market behavior. When retail traders become too fearful, it often suggests the market may be nearing a turning point.

The current surge in FUD could lead to a period of accumulation for institutional traders and long-term holders. Such market conditions have historically set the stage for price rallies.

Social Media Sentiment Drives XRP’s Short-Term Movements

Social media plays a crucial role in shaping market sentiment, and the recent rise in negative commentary about XRP has caught the attention of traders. On September 17th, for instance, the bullish-to-bearish ratio stood at an extreme 3.21, suggesting that the crowd was overly euphoric and possibly setting up for a price correction.

Fast forward to October 6th, and the ratio dropped, with fear beginning to dominate social media discussions, potentially signaling an opportunity for price growth.

In such cases, XRP traders should remain cautious of the crowd’s behavior. The growing fear among small traders often precedes a market reversal, as larger investors tend to act contrary to the emotions of the broader public.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.