XRP has surged past the $2 mark, delivering a staggering 300% gain since its pre-rally base in November 2024, according to recent data from Glassnode.

The cryptocurrency, which hit a peak of $3.31 in January 2025—driven by a rare RSI Golden Cross signal—has captured the attention of investors and analysts alike. This rally, outpacing Bitcoin’s 50% growth over the same period, underscores XRP’s resilience, bolstered by its adoption as a treasury reserve asset by Saudi-backed VivoPower and U.S. support for a crypto stockpile under President Trump.

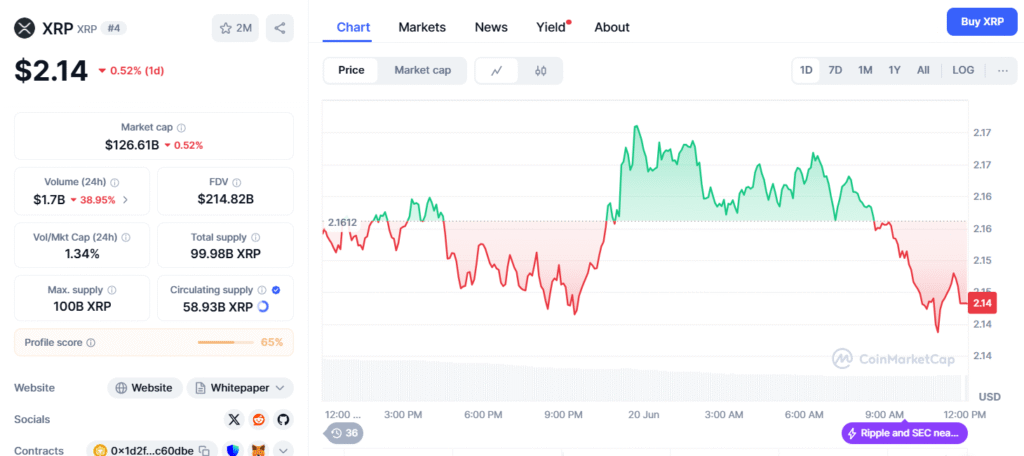

However, the tide may be turning. Glassnode reports that early investors are now realizing profits at a rate of $68.8 million per day (7-day SMA), signaling a wave of distribution by long-term holders. This shift from accumulation to profit-taking aligns with on-chain insights, where advanced clustering algorithms reveal a cautious market stance. The 34% drop in trading volume, coupled with oversold RSI and MACD indicators highlighted by X Finance Bull, suggests potential volatility ahead. If the $1.60 support level cracks, sharper downside risks could emerge.

Despite this, bullish sentiment persists, fueled by XRP’s growing role in DeFi and the highly anticipated launch of an XRP ETF, which could bridge traditional finance and crypto markets. The tightening triangle pattern noted by U.Today, with a range between $2.25 and $2.40, hints at a possible breakout, potentially pushing prices toward $2.80 if momentum returns.

For investors, this moment calls for vigilance. While the 300% gains reflect XRP’s strength, the current profit-taking wave and technical indicators suggest a consolidation phase. Stay tuned to Coincryptonewz for real-time updates as the market navigates this critical juncture.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.