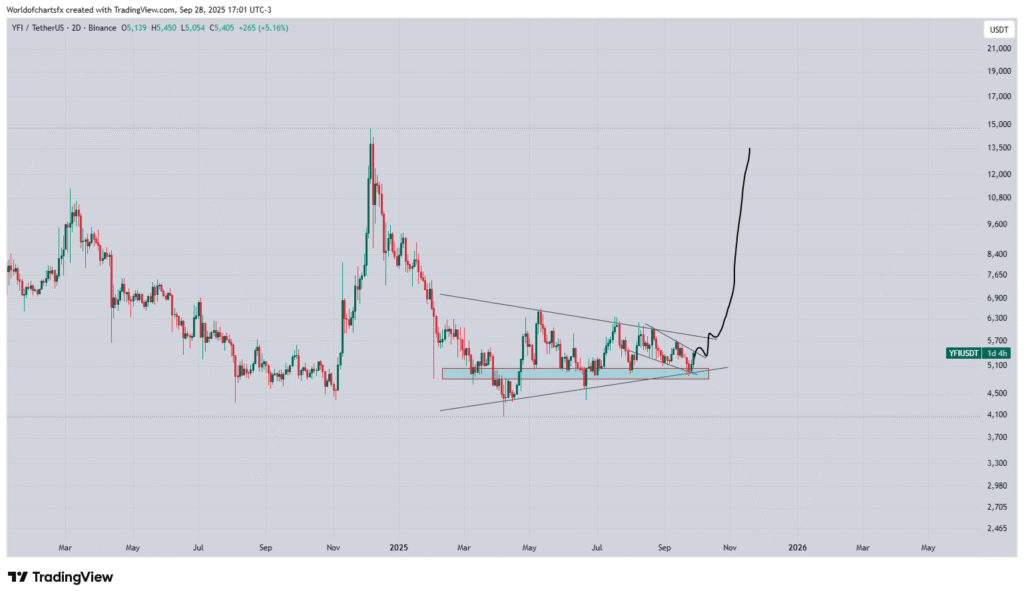

- $YFI’s price consolidation suggests a breakout could lead to a 2x surge if resistance is breached.

- Analysts predict a strong rally for $YFI if the $5,700 level is surpassed in the coming weeks.

- Yearn Finance has launched a USDS vault with Term Labs to improve DeFi yield generation and liquidity.

$YFI, the token for Yearn Finance, has been consolidating within a narrow range since mid-2023, forming a symmetrical triangle pattern on its price chart. The price has repeatedly struggled to break the $5,700 resistance level.

Analysts now predict that this consolidation is nearing an end, and a potential breakout is on the horizon. If $YFI successfully breaks above this resistance level, a sharp rally is expected, with some experts forecasting a 2x increase in its value.

Historically, when such symmetrical triangles form and the range is broken, significant price movements follow. This buildup of momentum suggests that investors should watch closely for any signs that the upper boundary of the triangle may be breached. Once the price clears $5,700, it could trigger a surge in demand, potentially sending $YFI’s value soaring.

Yearn Finance Expands DeFi Offering with New USDS Vault

Yearn Finance is further expanding its DeFi ecosystem by curating a new USDS vault in collaboration with Term Labs. This vault integrates Term’s fixed-rate lending auctions with Yearn’s yield optimization strategies.

The partnership aims to strengthen DeFi infrastructure by combining Term’s price discovery with Yearn’s efficient yield generation tools. However, the new vault has generated positive feedback from analysts, who note that it brings greater transparency and composability to the ecosystem.

This collaboration is part of Yearn’s ongoing efforts to innovate within the DeFi space and offer more robust solutions for users. By combining fixed-rate lending with yield optimization, the partnership is expected to attract more liquidity and provide better returns for DeFi users.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.