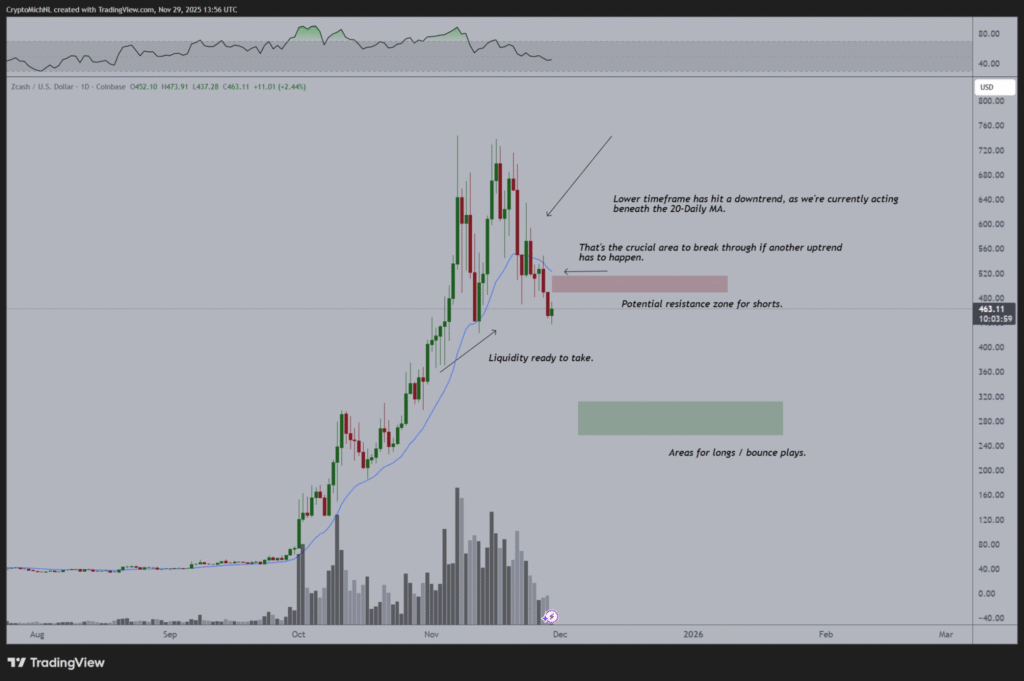

- Zcash is currently trading below the 20-day moving average, indicating a short-term downtrend.

- Resistance is found between $500 and $520, a key area for potential short positions.

- Support for long entries or bounce trades is seen in the $270-$300 range.

Zcash has entered a short-term downtrend, slipping below its 20-day moving average and signaling a loss of bullish momentum. Traders are now closely watching two key price zones that could determine the coin’s next move.

Zcash Shows Weakness Below Key Moving Average

Zcash (ZEC) has moved into a downtrend on the lower timeframes, as noted by crypto analyst Michaël van de Poppe on X. The coin is currently trading below the 20-day moving average, a key short-term trend indicator. This shift suggests momentum has slowed since the recent rally, which saw ZEC briefly climb toward the $700 mark.

According to van de Poppe, “Lower timeframe has hit a downtrend, as we’re currently acting beneath the 20-Daily MA.” He adds that for any upside reversal, a clear break above this average is essential.

Price has entered a critical resistance zone between $500 and $520. This level is identified as a strong short area unless bulls manage to reclaim it.

Bounce Zones and Future Trend Signals to Watch

As Zcash continues to correct, a key support region has been identified between $270 and $300. This area is marked as a potential bounce zone or long entry level. Traders may focus on this price range for re-entry if the price continues to slide.

The chart also reveals that there is “liquidity ready to take” below current price levels. This suggests that if ZEC drops further, buyers may step in around the $270–$300 region to support a possible rebound.

The setup outlined by van de Poppe provides two critical zones for market participants. The upper zone ($500–$520) must be cleared to confirm any new bullish trend. The lower zone ($270–$300) is considered favorable for those looking for value entries or bounce trades.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.