In a striking development for the cryptocurrency market, $3.45 billion worth of XRP was transacted within a 24-hour period, While this marks a significant spike in activity for the XRP ecosystem, the outlet’s cryptic conclusion—that it’s “not yet enough”—has prompted debate about whether volume alone can catalyze XRP’s long-anticipated breakout. The question many investors are asking now is: what exactly is missing?

A Familiar Pattern of Volume Surges Without Price Breakouts

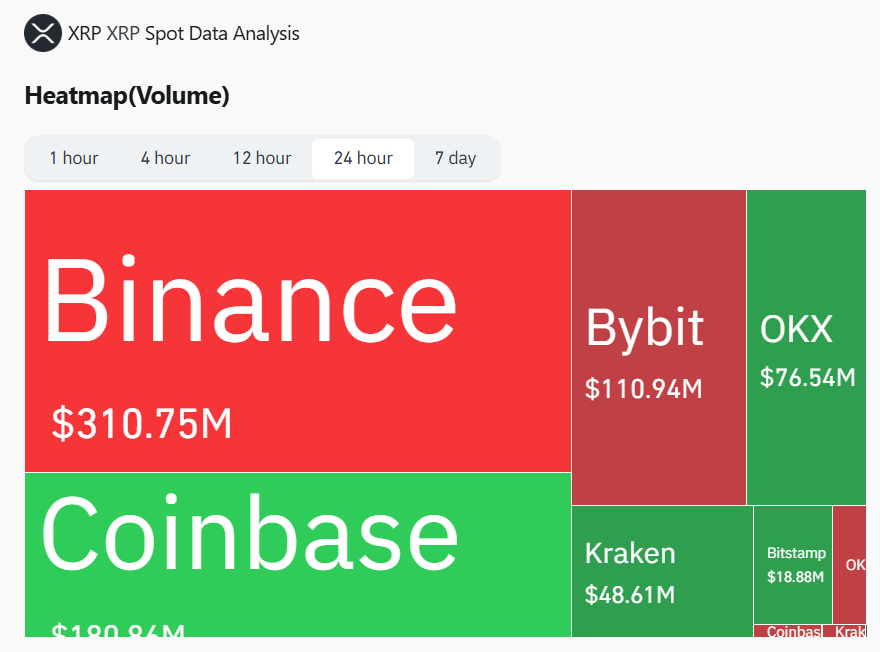

The $3.45 billion surge mirrors a previous spike observed on March 8, 2025, when XRP’s 24-hour volume reached $3.35 billion amid rising leverage and speculative momentum. Then, leading exchanges like Binance and Bybit contributed heavily to the volume, processing over $1.1 billion combined in XRP trades. Today’s volume reflects similar enthusiasm, likely fueled by a mix of institutional positioning and retail speculation. However, despite the sheer scale of trading activity, XRP’s price action has remained stubbornly subdued—hence the sentiment that it’s “not yet enough.”

Institutional Adoption on the Horizon

Several key developments have contributed to this resurgence in volume. Chief among them is the May 29 announcement from Hyperscale Data (NYSE: GPUS) that its subsidiary, Ault Capital Group (ACG), plans to launch an XRP-based lending platform by Q3 2025. The platform will target publicly traded companies listed on the NYSE and NASDAQ, offering fast and cost-efficient liquidity via the XRP Ledger. ACG also revealed plans to acquire $10 million worth of XRP and hedge its exposure through futures contracts on the Chicago Mercantile Exchange (CME). This move signals increasing institutional interest in XRP, particularly for enterprise-grade financial use cases.

Bullish Sentiment Fueled by Analyst Predictions

This institutional push comes amid growing market sentiment around XRP’s long-term prospects. Prominent analysts have expressed bullish views: John Bollinger, creator of Bollinger Bands, recently labeled XRP a market leader, while crypto strategist Egrag Crypto projected a potential parabolic rally. Using Elliott Wave theory, Egrag predicts that XRP could reach between $22 and $24 in the medium term, with long-term targets as high as $95–$110. These optimistic forecasts have likely encouraged speculative trading, helping drive up the recent $3.45 billion volume figure.

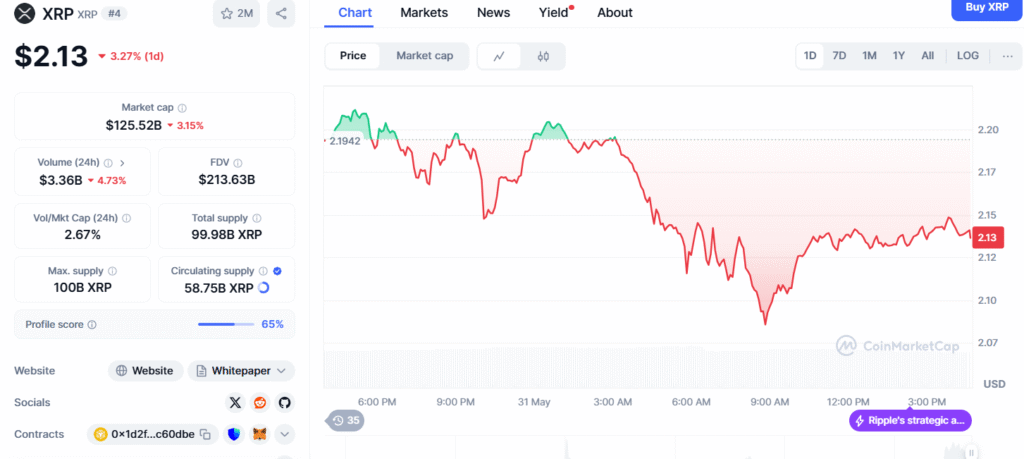

Why the Volume May Not Be Enough

Yet despite this momentum, XRP’s price has not reflected the same enthusiasm. The coin remains below the psychologically critical $3 mark and far from its all-time high of $3.84. This lack of price traction despite massive volume suggests that the market may be experiencing high turnover without meaningful accumulation—a potential sign of trader uncertainty or profit-taking at resistance levels. U.Today’s phrase, “not yet enough,” may thus reflect the market’s failure to deliver a breakout or trigger a new bullish trend, despite impressive transactional figures.

Bearish Technical Risks Still Loom

Adding to the complexity is a bearish technical setup. According to a separate U.Today analysis, XRP may face a 66% drop against Bitcoin, based on Bollinger Band compression and weakening relative strength. If such a correction materializes, it could severely undermine confidence in the current rally and cast doubt on bullish predictions. Moreover, the long-running Ripple v. SEC lawsuit continues to hang over XRP like a cloud. The lack of regulatory clarity has kept many institutional investors on the sidelines and stifled broader adoption. A favorable or final resolution could be the catalyst XRP needs—but until then, uncertainty persists.

Comparing XRP Within a Volatile Market

It’s also important to place XRP’s performance in context with broader market dynamics. Other major tokens are seeing mixed results. For instance, Shiba Inu ($SHIB) is struggling, with open interest falling to just $172 million. Cardano ($ADA), on the other hand, posted a 40% spike in volume but barely moved in price—another sign that volume alone may no longer drive upside. Meanwhile, Bitcoin and Ethereum have seen modest recoveries after recent dips, suggesting that the overall market remains volatile and directionless. In this climate, XRP’s volume, while impressive, does not yet differentiate it enough to catalyze a sustained rally.

What Lies Ahead for XRP

Looking ahead, XRP’s trajectory will depend on several crucial factors. The successful launch and adoption of ACG’s lending platform could bring meaningful institutional inflows, provided it gains traction with listed companies. Regulatory developments—particularly in the Ripple-SEC case—will play a pivotal role in shaping market sentiment and investor confidence. From a technical perspective, XRP must clear critical resistance levels and sustain upward momentum to meet bullish projections. Until then, large volume spikes may continue to look impressive on paper while delivering limited progress on the charts.

Conclusion: XRP’s Paradox of Activity Without Ascent

In conclusion, the $3.45 billion in XRP transactions represents a strong show of interest in the token’s utility and future. However, as U.Today noted, it is “not yet enough” to overcome the lingering obstacles holding XRP back. Whether the token can turn this surge into a lasting breakout remains to be seen—but it’s clear that volume alone won’t be sufficient. The crypto world is watching closely to see whether XRP can align market activity, technical strength, and regulatory clarity to finally fulfill its long-promised potential.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.