- NFT trading volume jumps 191% from July 1 to July 21, 2025 — rising from $11M to $32M.

- Renewed interest possibly driven by seasoned traders and active NFT holders.

- Sustainability and real-world use cases may fuel a long-term recovery.

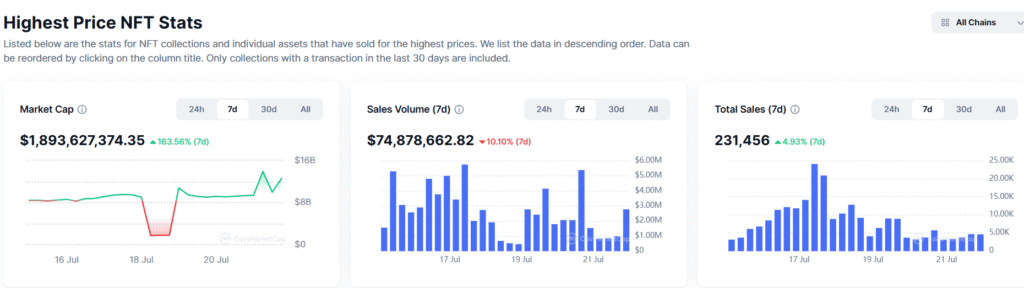

After a long crypto winter for NFTs, new data suggests a potential market rebound may be underway. According to a recent X post by crypto analyst Joao Wedson, NFT trading volume spiked dramatically in July — from $11 million on July 1 to $32 million by July 21, marking a 191% surge in just three weeks.

Wedson’s accompanying graph highlights not only rising trading volume but also an increase in active holders and newly minted or traded NFTs, signaling genuine engagement, not just speculative spikes. While the market may not revisit the frenzied heights of 2021–2022, this momentum reflects a healthier, more measured form of growth.

Historical data adds context to this optimism. Platforms like Blur previously ignited spikes in activity during 2023 via zero-fee models and token airdrops, causing NFT volumes to rise over 120%, even with lower transaction counts — a sign that experienced participants were driving those rallies. Similarly, Altcoin Buzz noted a staggering 4,700% growth in NFT volumes since early 2021, largely fueled by strong communities and functional use cases.

More recently, sustainability and utility are reshaping the NFT landscape. With Ethereum’s switch to proof-of-stake, reducing energy usage by 99.99%, and platforms like Klever pushing eco-conscious minting, the space is becoming more aligned with global ESG trends — attracting eco-conscious investors.

Yet caution remains warranted. Research from Scientific Reports analyzing over 6 million NFT trades (2017–2021) reminds us of the market’s speculative roots. Still, the rise in unique buyers and sellers this month hints at diversified, organic growth rather than hype-driven trading.

As we head toward Q4 2025, the NFT market’s future hinges on whether this surge reflects a true comeback or just a temporary bounce. For now, traders and collectors alike have reason for measured optimism.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.