- ADA breaks above long-term trendline after months of consolidation.

- ETF filings for Cardano could expand institutional market exposure.

- Holding above $0.80 remains crucial to sustain current bullish momentum.

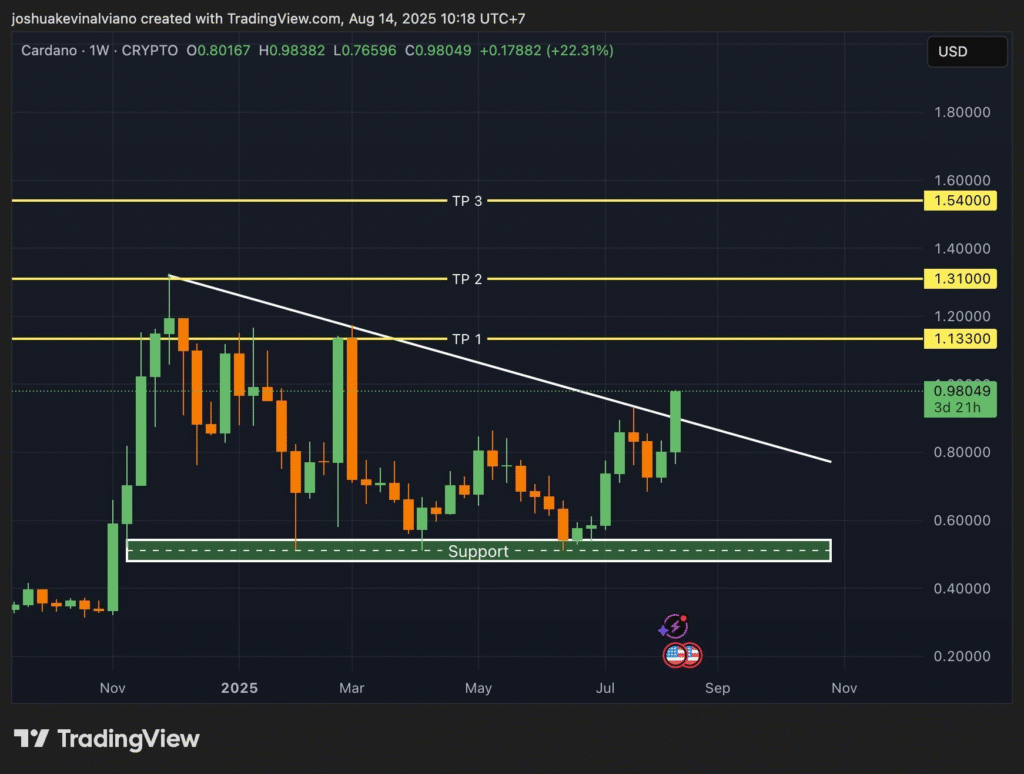

Cardano has moved above a descending trendline after months of consolidation. Cardano ($ADA) surged 22% this week to $0.98049 after breaking its long-standing trendline.

The move followed months of consolidation above the $0.55–$0.60 support zone. Technical analysts set upside targets at $1.13 (TP1), $1.31 (TP2), and $1.54 (TP3) if the breakout holds.

They stressed that maintaining a price above $0.80 is crucial to sustain the bullish outlook. A decline below this threshold could invalidate the breakout and trigger a retest of key support.

ETF Developments and Regulatory Outlook

NovaDius Wealth Management President Nate Geraci told CNBC that several ETF filings for Cardano ($ADA), Hedera ($HBAR), Solana ($SOL), and Ripple ($XRP) are in progress.

Geraci said approval for an ADA ETF is expected in the fourth quarter of this year. He also stated that a standardized U.S. crypto regulatory framework could be in place within two months.

Market analysts believe such regulation could pave the way for ETF launches, expanding institutional access beyond Bitcoin and Ethereum. CoinCryptoNewz reported that Grayscale has registered Cardano (ADA) and Hedera (HBAR) Trust ETFs in Delaware, listing CSC Delaware Trust as the registered agent.

Analysts view this as a potential step toward a U.S. SEC spot ETF application. The development has fueled speculation that ADA ETFs could act as a catalyst for the next cryptocurrency bull run.

Market Performance and Investor Sentiment

Cardano became the largest daily gainer among the top 100 cryptocurrencies, rising 18.30% in 24 hours to $1.01.The asset’s market capitalization now stands at $35.98 billion.

Over the past week, ADA has climbed 36.00%, and in the last 30 days, it has gained 39.86%. Analysts noted that the recent performance reflects renewed investor confidence despite persistent market skepticism about Cardano’s long-term competitiveness.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.