- Bitcoin broke below EMA50, raising concerns about deeper price corrections.

- Franklin Templeton’s CEO said blockchain disruption outweighs Bitcoin’s role.

- Analysts noted crypto bill passage could trigger massive institutional inflows.

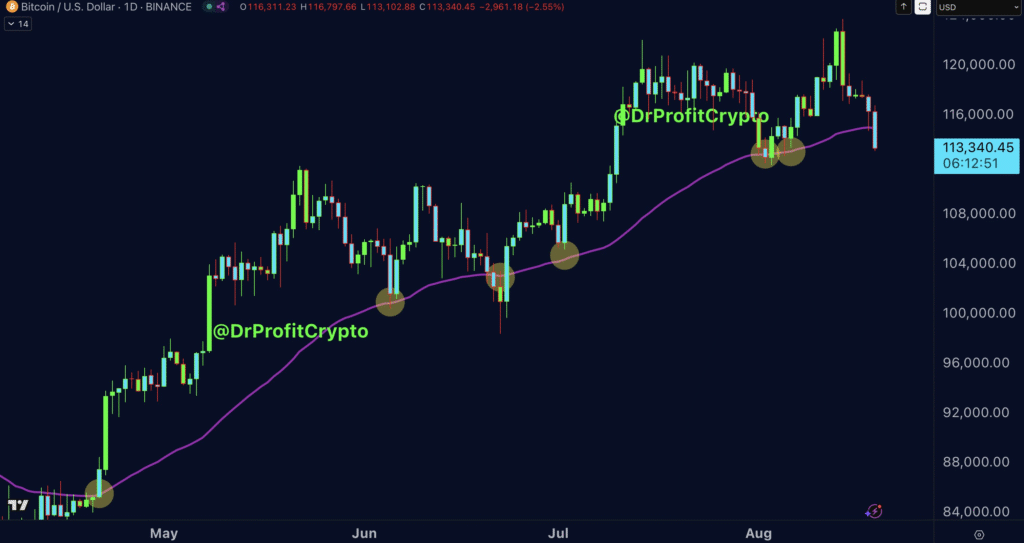

Bitcoin showed renewed weakness as it fell under a key technical level. Crypto analyst Doctor Profit said the EMA50 has long been a “golden line” in his forecasts.

The moving average acted as a support level during multiple rallies in recent months. This time, Bitcoin broke below the EMA50 “like butter,” according to his analysis.

He stressed that he did not even consider the line as support in this cycle. Traders now see why the level failed to hold.

Bitcoin traded near $113,340 after the breakdown. The move comes after the price held above the EMA50 since April.

Charts highlight several rebounds off the moving average before the latest slide. Losing the EMA50 raises fears of a deeper correction if buyers fail to step in.

Franklin Templeton CEO Highlights Blockchain

Jenny Johnson, President and CEO of Franklin Templeton, shared her outlook in a recent interview. She called Bitcoin the “greatest distraction” from what she views as the real disruption. Johnson said blockchain technology holds greater transformative potential for financial services.

Analysts said her comments balanced the debate around digital assets. While Johnson acknowledged Bitcoin’s popularity, she pointed to blockchain’s broader applications.

Her remarks highlighted the growing divide between asset-focused and technology-focused strategies.

Regulatory Progress Sparks Institutional Optimism

Caitlin Long appeared live on CNBC to confirm that the U.S. House will pass the crypto market structure bill. She underlined the importance of regulatory clarity for digital assets.

The news sparked optimism across the crypto industry. Analysts said trillions in capital could flow into the market with clear rules, and they described the bill as a possible turning point for institutional adoption.

Separately, analyst Quinten noted that Bitcoin flipped an eight-year resistance line into support. His chart showed a long-term trendline near $113,729, which is now acting as a base.

He said ignoring the strength of this breakout would overlook a major structural shift. Analysts added that turning multi-year resistance into support often signals a new bullish cycle.

At press time, Bitcoin is trading at $113,448.92, down 2.32% in the past 24 hours. The price slid from around $116,350 earlier in the day. Charts showed a steady downward trend following the EMA50 breach.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.