- DYDX traders test breakout levels with a possible 100% upside move.

- Surge Season 5 offers double $3 million rewards for active traders.

- Analysts stress DYDX must sustain above resistance to maintain strength.

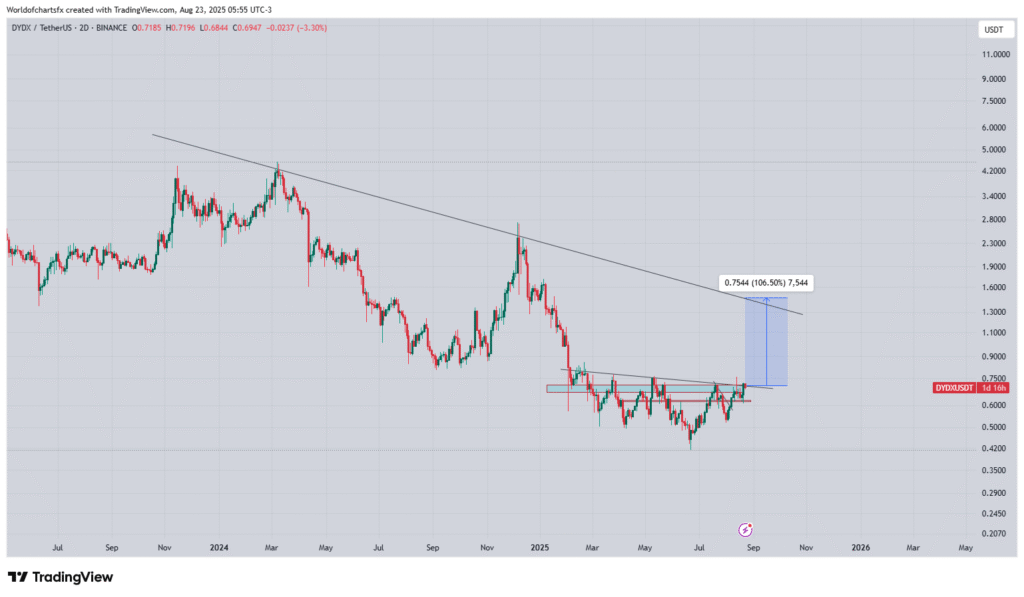

DYDX is showing signs of renewed strength as it prepares for a critical resistance test. The token has consolidated within a horizontal channel for months, attracting close attention from traders. Analysts note that momentum is building as buyers challenge the breakout level.

Technical Outlook Points to Breakout Levels

World Of Charts data shows DYDX is struggling to clear a crucial resistance range but holding firm. The chart highlights that the token has remained inside an extended consolidation phase.

Analysts said that a breakout could trigger a bounce toward the descending trendline. The projected target stands near $1.30, which represents a move of over 100% from its current level of $0.64.

However, the resistance zone remains a decisive barrier. Analysts stressed that DYDX must sustain trading above the breakout zone to preserve momentum.

They added that failure to hold this level could limit upside potential. At press time, DYDX is trading at $0.6923, down 1.3% in the past 24 hours.

Surge Season 5 Boosts Trading Incentives

Meanwhile, dYdX Foundation announced the launch of Surge Season 5, with only one week left to join. The program allocates $3 million in DYDX rewards to traders.

According to the foundation, the monthly pool has doubled compared to prior rounds. This makes it one of the largest on-chain trading incentive programs currently available.

Analysts said the initiative could strengthen dYdX’s competitive position in decentralized trading. They noted that higher reward pools may attract increased trading activity.

More user participation could also enhance liquidity across the platform. The timing of Surge Season 5 adds another layer of interest as DYDX tests a key breakout level.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.