- Exchange inflows rose from 34B to 51B SHIB in one day.

- A whale withdrew 204.3B SHIB from Coinbase over three days.

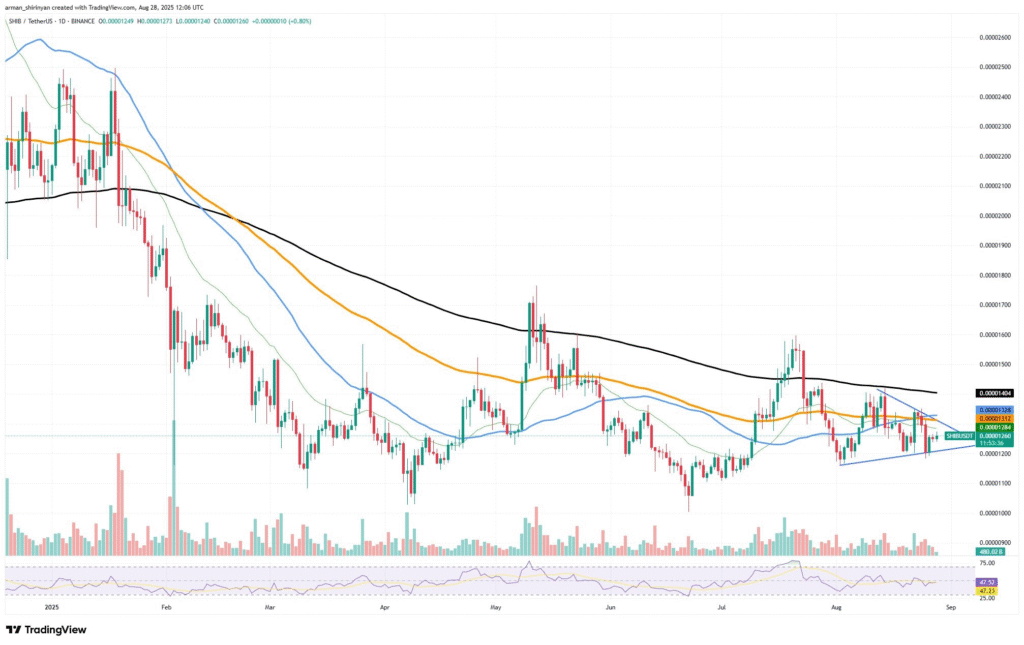

- SHIB trades near $0.0000126 inside a tightening symmetrical triangle.

Shiba Inu is at a crucial stage as traders prepare for potential volatility. Exchange inflows for the token have surged sharply, suggesting possible selling pressure. At the same time, the price has entered a narrow consolidation range that could break soon.

Exchange Inflows Signal Possible Selling Pressure

CryptoQuant data showed that SHIB inflows to centralized exchanges jumped from about 34 billion to over 51 billion in one day, one of the largest single-day increases in recent months. Large transfers to exchanges are often linked to selling pressure, as investors move tokens to liquid markets.

The sudden inflows came while SHIB traded around $0.0000126 inside a symmetrical triangle that has been forming since July. The token was locked between resistance at $0.0000132 and support at $0.0000120.

Concerns are heightened because SHIB continues to struggle below its 100-day and 200-day exponential moving averages. These levels have acted as firm resistance throughout recent trading sessions.

The Relative Strength Index stood at 47, showing weak momentum and limited bullish conviction. Trading volume also remained lower compared to previous surges, pointing to reduced buying appetite if selling accelerates.

Whale Accumulation Counters Weak Sentiment

While inflows suggested possible selling, whale activity provided a contrasting signal. Data confirmed that a single investor withdrew 204.3 billion SHIB from Coinbase across 14 transactions in three days, each involving at least 15.31 billion tokens.

Following these withdrawals, SHIB regained stability after briefly testing the $0.00001 support zone. The token bounced from its August 25 low of $0.00001188, which marked a two-week bottom. Price recovery pushed SHIB back above its nine-day moving average, easing fears of extended downside risks.

Traders noted that SHIB gained 2.72% in a single day and 1.45% over the past week. The rebound was supported by strong accumulation, which boosted market sentiment.

At the time of writing, SHIB traded near $0.00001270, holding firm above key support levels while awaiting resolution of its consolidation pattern.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.