- Triangle Formation Holds Strong – Dogecoin maintains its ascending triangle near $0.20, with rising volumes signaling momentum for a potential breakout.

- Technical Indicators Align – RSI near 67 and bullish MACD support upward pressure, but caution remains with overbought levels approaching.

- Decision Point Ahead – DOGE’s next move hinges on whether $0.217 resistance breaks or if consolidation turns into a false breakout.

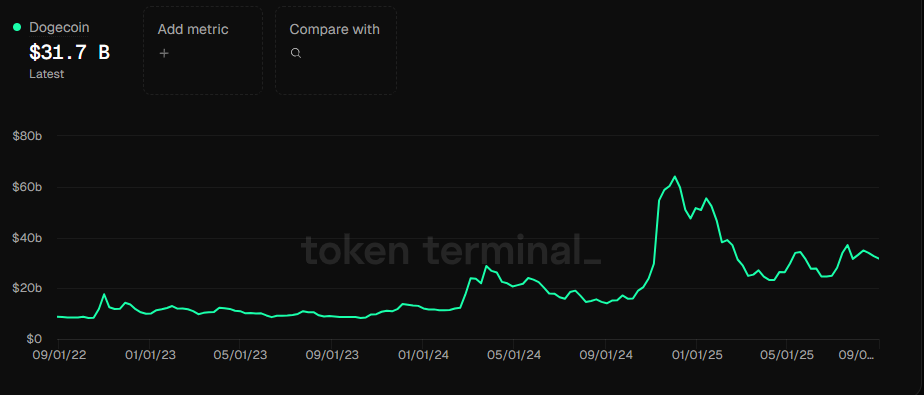

Dogecoin has held its ascending triangle structure near $0.20 while trading volumes spiked to $13.49 billion. The circulating market cap reached $31.7 billion, recalling the $40 billion peak from July. Current dynamics suggest that momentum may be forming for another major price attempt.

Price action shows Dogecoin trading near $0.2159, gaining 1.64% at the time of the last reading. Intraday activity displayed multiple surges followed by consolidation above $0.214. Buyers kept control, with higher lows confirming the strength of the short-term structure.

Dogecoin’s resilience reflects its ability to hold above the $30 billion market cap level despite prior corrections. Volume expansion has added significance, as surges often precede breakout attempts. If sustained, this pattern could trigger further speculative participation in the near term.

Technical Readings and Market Indicators

Momentum indicators show both strength and potential constraints for Dogecoin’s next move. The Relative Strength Index stands near 67, reflecting bullish energy but approaching overbought territory. A move above 70 would signal risk of a near-term pullback.

The MACD reading also supports ongoing momentum, with the MACD line staying above the signal line. Both indicators are trending upward, though the histogram shows narrowing, which suggests consolidation is possible. This combination often signals preparation for a decisive price action phase.

Volume analysis reinforces the trend, as spikes aligned with upward moves confirm strong participation. During sideways movement, activity tapered, suggesting less urgency. Sustained elevated volumes will be essential if price is to push past $0.217 resistance.

Broader Structure and Market Context

Over the last three years, Dogecoin’s circulating supply expanded steadily to 150.7 billion tokens. Unlike capped-supply cryptocurrencies, its inflationary model increases availability, which creates pressure on demand to maintain value. Despite this, Dogecoin’s market cap growth shows persistent support.

Long-term data reveals cyclical behavior, with market capitalization ranging from $10 billion in 2022 to peaks above $60 billion in 2024. The pullback in early 2025 cut valuations nearly in half, but Dogecoin stabilized within the $30–$40 billion range. This stabilization reflects ongoing relevance, even when speculation cooled.

Revenue generation remains limited, with fees for the last 30 days reaching only $94.1K. Revenue recorded $0, highlighting the meme-driven role of Dogecoin rather than a transaction-heavy blockchain. Despite this, community and retail activity continue to anchor its valuation above key thresholds.

Breakout or Trap Ahead

Dogecoin now faces a critical decision point as it consolidates within its triangle structure. A break above resistance would likely trigger further technical buying. However, the risk of false breakouts remains high, especially in speculative markets.

Traders will focus on whether demand holds near current levels and whether volumes confirm the move. If demand aligns with liquidity surges, a rally could strengthen rapidly. If not, Dogecoin may retrace toward lower support zones.

Either way, consolidation appears near completion, and the next move will likely set the tone for Dogecoin’s medium-term cycle. Market history shows the asset thrives on retail enthusiasm, and any catalyst could reignite sharp volatility. For now, Dogecoin stands at a pivotal stage, balancing momentum against resistance.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.