- The spot demand is also paramount: Sustainable Bitcoin rallies are historically associated with trading derivatives.

- Derivatives are volatility-generating: Futures and perpetual contracts have the greatest volume, but high leverage frequently leads to liquidations and uncharacteristic short-term flows.

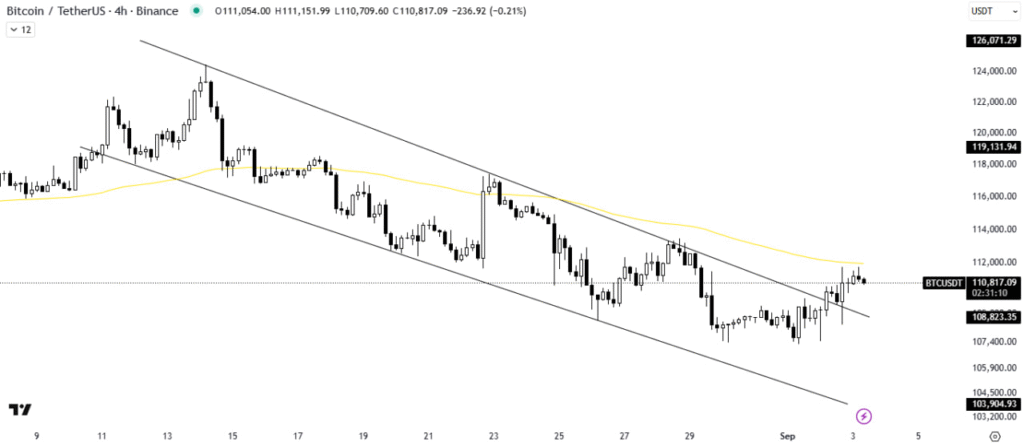

- The critical levels determine outlook: Support is close to near 108,800, and resistance areas of 112,000 and 119,000 will determine the next decisive movement.

The market structure of Bitcoin remains characterized by a dramatic gap between the demand and derivative action in the spot market. Recent statistics indicate that derivatives take the centre stage in terms of daily volume, whereas spot trading is still comparatively feeble. This opposition begs the question of whether it is possible to maintain rallies without actual demand.

Direct buying and selling without leverage is known as spot volume. It gives a better indicator of the strength in the market, since most of the time, demand will be reflected in a prolonged price trend. The large rallies were historically associated with robust and stable fluctuations in spot participation.

Thus, retail demand is critical to effective growth. Upside trends are likely to persist when price rallies accompany upsurge in spot activity. In the absence of this validation, leverage-induced rallies seem susceptible to counter-movement.

Derivative Moves and Moves of Short term.

Most trading in Bitcoin markets is now being conducted through derivatives. Perpetual contracts and futures are the order of the day, and leverage is driving the changes. Yet, such speculative trades tend to increase volatility and cause unstable short-term movements.

Leverage creates opportunities for quick gains, but liquidations magnify losses when markets reverse. This process often sparks sharp declines following sudden rallies. Consequently, derivative-driven moves lack the long-term stability that spot trading provides.

Market data shows derivative activity consistently exceeding spot participation. This dominance illustrates how speculation shapes price action more than organic demand. As a result, market conditions remain vulnerable to abrupt swings.

Technical Levels and Current Outlook

Bitcoin recently exited a descending channel formed through late August. The breakout suggested waning bearish pressure and opened the door to recovery. Retesting the former resistance confirmed new support around $108,800.

Source: TradingView

The immediate resistance is the four hour moving average of around 112,000. An immediate rise above this may reinforce bullish action up to a high of 119,000. But the inability to regain this height may lead to new consolidation or losses.

The longer term resistance is close to $126,000 with the critical support standing at 103,900. The direction in the market now relies on whether spot demand is increasing or leverage remains the order of the day. Sustained spot activity would provide the foundation for a more durable rally.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.