- Ethereum Exchange Outflows Reach Record Levels – ETH’s negative exchange flux balance signals coins shifting to wallets, staking, and DeFi platforms, tightening supply.

- Bitcoin BTC is a strong bull, but with temporary technical threats, which are supported by the fact that the trading volume is on the rise, and the price is above the critical levels.

- ETH Futures Open Interest Soars past 50B, Speculative buying increases, and both the potential to rise as well as the risk of volatility become even higher in the market.

Ethereum has entered a new phase in market dynamics as exchange outflows reached record levels. For the first time, its exchange flux balance turned negative, showing more ETH leaving exchanges than entering. This suggests coins are moving into wallets, staking contracts, and decentralized platforms instead of remaining available for trading.

The decline in exchange balances indicates a tightening liquid supply that could influence future price action. When demand remains strong, lower supply often creates upward momentum. This marks a significant shift in Ethereum’s structural setup, with long-term implications for market stability.

These outflows are also notable because Bitcoin mirrors a similar pattern. Both assets show billions of dollars exiting exchanges simultaneously. Such coordinated outflows reduce immediate selling pressure but can also create lower liquidity across the crypto sector.

Bitcoin Price Action and Volatility

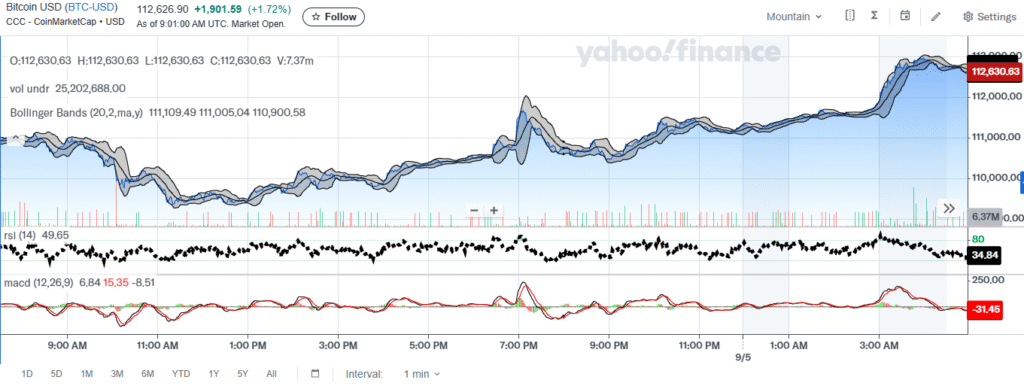

Bitcoin is trading firmly around $112,630, posting a daily gain of 1.72%. Major fluctuations in price occurred between 7:00 PM and 3:00 AM which took BTC over $112,000. Bollinger Bands widened when volatility increased and the price now follows close to the upper band indicating a bullish trend.

Source: Yahoofinance

Relative Strength Index is neutral at 49.65 and it will gain further should demand persist. Momentum remains positive, however, the Moving Average Convergence Divergence indicates a bearish crossover price movement, indicating potential temporary weakness. This dislocation may stutter before proceeding.

Trading volumes are increasing, which supports the high level of market participation in the rally. The above keeps the bullish setup intact and momentum is maintained at 112,000 and above. But lack of support defense could elicit a short-term pullback of up to $111,000.

Ethereum Futures and Market Implications

Ethereum’s futures market highlights rising speculative engagement alongside price growth. ETH climbed from $1,500 in late 2023 to above $4,500 by August. Open interest moved in parallel, showing leveraged participation expanded with price momentum.

Source: Coinglass

March and April were particularly strong with ETH holding as high as $4,000 and open interest soaring. Corrections followed these rallies, which means that leverage contributed to both the gains and the losses. Open interest increased once more by July and August, reaching beyond $50 billion as ETH reached $4,800.

The increase in open interest is an indication of confidence in the market to continue bullishly. Price movements tend to be more influential and volatility risks are higher in high leverage. At a price of ETH higher than 4,000, we can expect further hits, but crashes may lead to aggressive liquidations.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.