- BlackRock’s $169M Bitcoin purchase strengthens its iShares Bitcoin Trust.

- Bitcoin breaks key resistance levels, signaling potential for long-term gains.

- The U.S. Producer Price Index (PPI) decline boosts investor optimism for crypto assets.

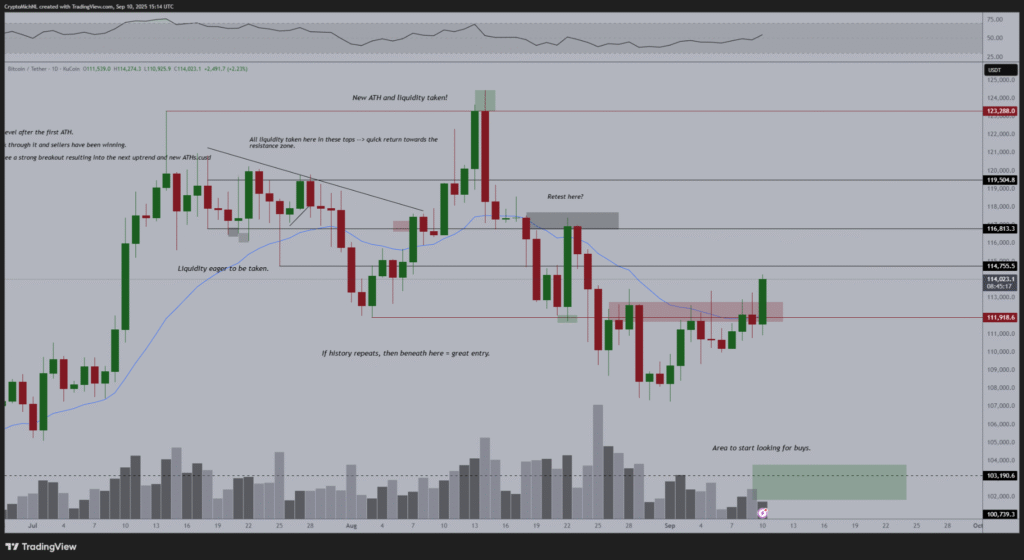

Bitcoin ($BTC) recently surged above a crucial resistance zone, signaling renewed bullish momentum. The breakout followed a period of consolidation in the market, where liquidity levels and previous highs were tested.

This phase created opportunities for both short-term and long-term traders. Michaël van de Poppe, a prominent market analyst, noted that this breakout could be a sign of further growth in Bitcoin’s price.

A key factor contributing to this shift is the significantly lower than expected U.S. Producer Price Index (PPI). This development is likely to reduce pressure on the Federal Reserve to raise interest rates, boosting investor confidence in Bitcoin and other assets.

The breakout above the 20-day moving average further reinforces the bullish sentiment surrounding Bitcoin. The new price levels now offer traders potential areas to re-enter, should history repeat itself in terms of market behavior.

Van de Poppe has pointed out that Bitcoin could continue its upward trajectory with altcoins poised to outperform in the near term. This shift is partly due to macroeconomic factors, including lower-than-expected inflation, which has increased the likelihood of future interest rate cuts.

BlackRock’s Strategic Bitcoin Investment

BlackRock, the world’s largest asset manager, made a substantial investment in Bitcoin, purchasing 1,520 BTC valued at $169.3 million. This purchase strengthens BlackRock’s iShares Bitcoin Trust (IBIT), which now holds 752,000 BTC. The acquisition aligns with BlackRock’s continued support of Bitcoin as a long-term store of value.

Larry Fink, the CEO of BlackRock, has expressed his belief that Bitcoin offers a unique opportunity for investors, particularly because of its low correlation with traditional financial assets.

The move also coincided with BlackRock’s allocation of $44.2 million to its Ethereum ETF, signaling broad institutional confidence in cryptocurrency markets. At the time of the purchase, Bitcoin was trading near $111,000, indicating that BlackRock is strategically accumulating Bitcoin during a period of market consolidation.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.