- Ethereum is testing $4,500 resistance with bullish momentum toward $5K.

- Analysts predict Ethereum could reach $8,000-$10,000 in 3-4 months.

- Institutional investments in ETH continue to support long-term growth.

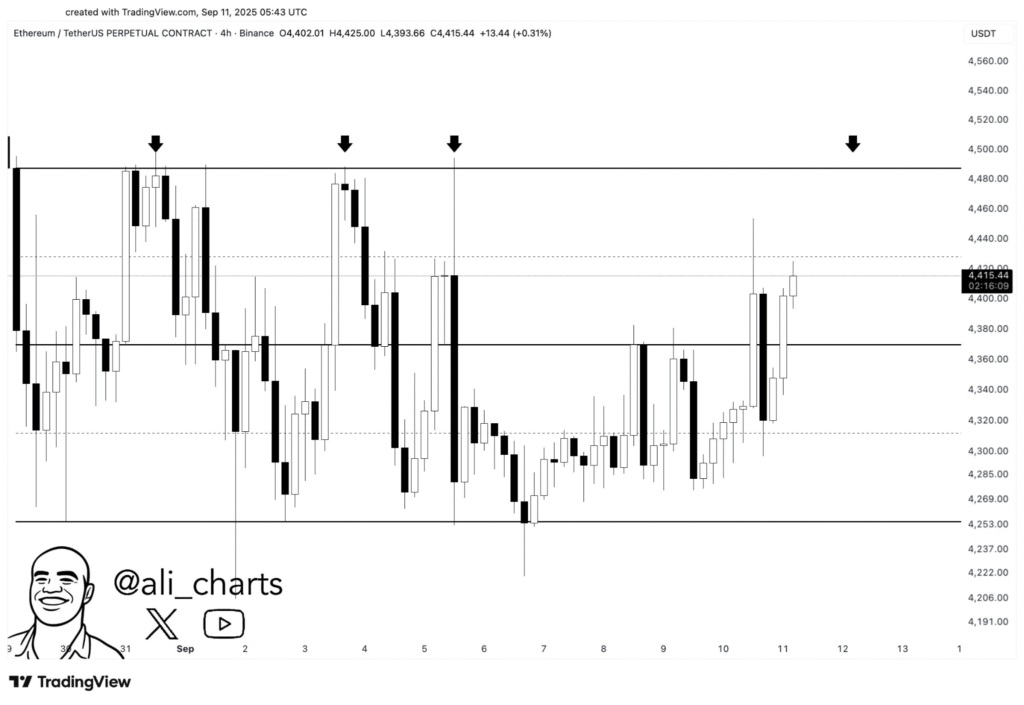

Ethereum (ETH) has once again reached a critical price point, testing the $4,500 resistance level. Over the past week, ETH has attempted to break above this zone several times but has faced repeated rejections.

According to market analyst Ali Martinez, the $4,500 mark is a significant barrier for Ethereum’s price. Despite multiple attempts to surpass this level, the resistance has proven strong, signaling that sellers are dominant around this price range.

Currently, Ethereum is trading near $4,415, showing bullish momentum after rebounding from the $4,300 support level. Should ETH manage to break through the $4,500 resistance, analysts predict that the next major target could be $5,000.

Ethereum’s potential to move past this key level is being closely monitored by traders and investors alike, as it could indicate the next phase of a bullish trend.

Market Analysts Draw Comparisons to Bitcoin’s Previous Cycle

Some market strategists are comparing Ethereum’s current market structure to Bitcoin’s accumulation phase of 2020–21. Analyst Ted Pillows noted that Ethereum shows signs of entering a mid-cycle correction similar to Bitcoin’s behavior before its explosive breakout.

This pattern suggests that Ethereum could experience significant price increases in the coming months. Pillows has also indicated that ETH could rally toward $8,000 to $10,000 within the next three to four months.

While short-term retracements remain a possibility, the general outlook for Ethereum is bullish. Other technical analysts, such as @crypto_goos, have also set a target of $7,000 following Ethereum’s recent breakout above $4,400.

Institutional Demand Fuels Ethereum’s Long-Term Prospects

Increasing institutional demand also supports Ethereum’s long-term growth. Blockchain data revealed that BitMine recently acquired $204 million worth of ETH, further signaling institutional conviction in Ethereum’s future. With a treasury now valued at $9.2 billion, BitMine’s investment reflects a strong belief in Ethereum’s upward trajectory.

Moreover, Fundstrat’s Tom Lee has projected that Ethereum could experience a 10-15 year supercycle, driven by greater institutional adoption and the integration of artificial intelligence.

Lee sees Ethereum becoming a cornerstone asset for institutional portfolios as network upgrades enhance its adoption and scalability. The rising interest from large institutions strengthens the positive outlook for Ethereum’s long-term prospects.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.