- Bullish Breakout Toward $2.50 – Celestia (TIA) broke out of a descending structure and now targets a potential 20%+ upside move.

- Stable Market Structure – With a market cap of $1.39 billion and $93 million in daily trading volume, TIA shows strong liquidity and resilience.

- Critical Resistance at $1.85 – Sustaining above $1.75 support and breaking $1.85 resistance will determine momentum toward the $2.50 target.

Celestia (TIA) currently trades at $1.79, marking a steady increase of 0.5 percent in the past 24 hours. The trading range between $1.74 and $1.84 reflects controlled volatility and sustained market engagement. This performance highlights a period of consolidation as the token builds momentum for a potential breakout.

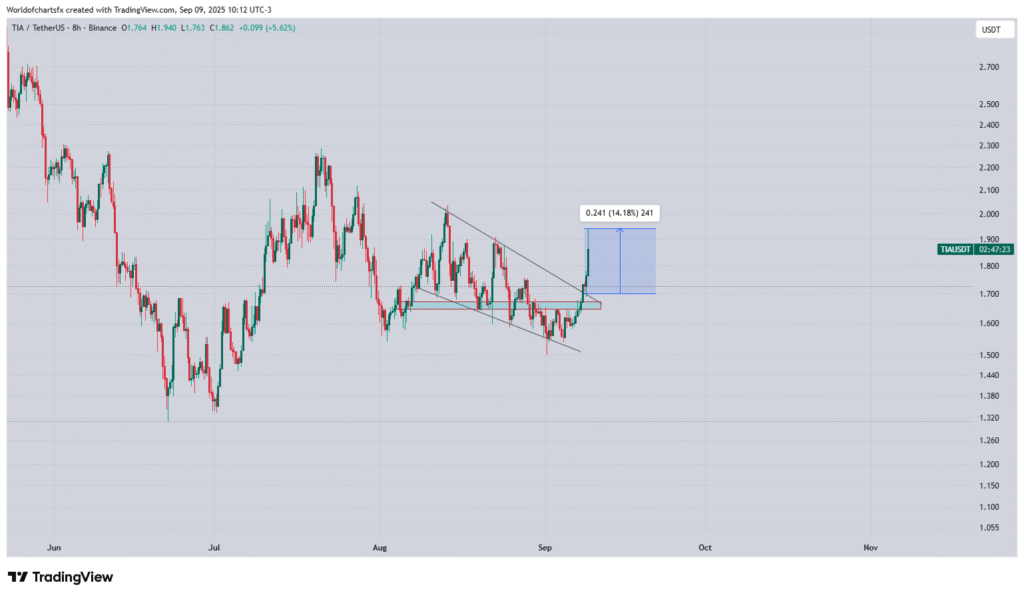

The chart setup indicates a breakout from a descending structure that had restricted progress for several weeks. Buyers accumulated within this range and supported a decisive upward move. The breakout now aligns with a technical projection toward $2.50, representing potential gains of more than 20 percent.

Sustained trading above the breakout zone signals confidence in the bullish structure. The pattern marks a transition from prolonged weakness to renewed strength. Moreover, the continuation of momentum suggests additional upside potential if key resistance levels break.

Market Snapshot Shows Stability

Celestia (TIA) maintains a market capitalization of $1.39 billion, positioning it among the stronger mid-cap digital assets. The fully diluted valuation stands higher at approximately $2.05 billion, reflecting future token circulation potential. The current circulating supply totals 778 million TIA, while maximum supply remains uncapped.

Source: Tradingview

Daily trading activity reached $93 million, underscoring strong liquidity and consistent activity on major exchanges. These levels demonstrate solid participation and reinforce confidence in price stability. Intraday movements show volatility but remain balanced by frequent recoveries after short pullbacks.

The token’s resilience is highlighted by its ability to maintain steady gains despite intermittent corrections. Price consistently returns to higher support levels, which strengthens the technical outlook. Consequently, TIA displays a balanced structure between volatility and sustained growth.

Resistance Levels Define Next Move

Current momentum emphasizes the importance of psychological resistance near $1.85, which capped several intraday rallies. A clear break above this level could set the stage for further price advancement. Conversely, a failure to hold current support might lead to consolidation phases.

source:Coingecko

The market structure reflects brief pullbacks followed by swift recoveries, confirming the underlying bullish sentiment. Peaks achieved during recent sessions highlight upward strength, while corrections remain limited in depth. Therefore, market behavior aligns with the overall bullish breakout trend.

TIA remains positioned for further gains as long as the token sustains levels above $1.75. Breakouts above nearby resistance could strengthen the trend toward $2.50. Overall, trading activity and technical indicators point toward continued upward potential in the near term.

Disclaimer: The information in this press release is for informational purposes only and should not be considered financial, investment, or legal advice. Coin Crypto News does not guarantee the accuracy or reliability of the content. Readers should conduct their own research before making any decisions.