- Trendline held, 3.00 is the hinge — XRP is consolidating above a multi-year break; hold 3.00 for continuation, lose it and 2.97–2.99 beckons.

- Trigger, then travel — A base above 3.02 and a push through 3.04 on rising activity opens 3.06–3.10; look for MACD and Aroon to turn up together.

- Context decides the cadence — Progress likely comes in steps as Bitcoin ranges and rotation improves; heavy supply $1–$2 caps parabolic hopes.

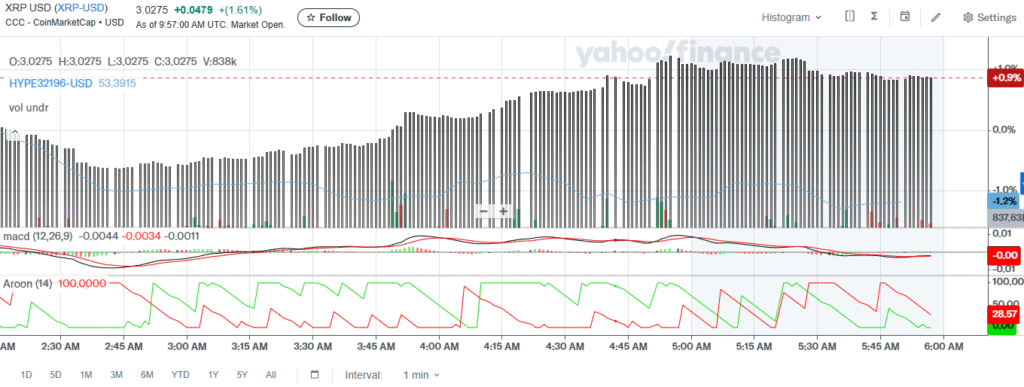

XRP trades above a long-term trendline and now pauses in tight consolidation. The move follows years of compression and a recent breakout. However, momentum has cooled, and market context will steer the next leg.

XRP

XRP broke a multi-year triangle and then held a narrow band above resistance. The setup mirrors an earlier base-wedge-breakout sequence, yet conditions differ today. Therefore, the pattern implies potential, but it does not guarantee repeat performance.

Source: Yahoofinance

Momentum signals now show balance rather than drive. MACD hugs the zero line while histogram bars remain small and alternating. Moreover, Aroon Up has eased as Aroon Down lifts, which often signals digestion.

Price action defines the roadmap. Bulls want weekly closes above the broken trendline and the current floor. Meanwhile, intraday structure treats the 3.00 area as a pivot for continuation or failure.

Source: Binance

A clear trigger would aid confirmation. A base above 3.02, followed by a push through 3.04 on rising activity, strengthens the case. Then, upside pockets cluster near 3.06 and possibly 3.10 if breadth expands.

Invalidation remains equally clear. Multiple closes back inside 3.00 with growing activity and negative momentum weaken the breakout. Consequently, price could revert toward 2.99 and then the mid-range.

Longer term, supply overhead still matters. Historical distributions between roughly one and two dollars may encourage profit taking on strength. Thus, progress likely comes in stages rather than in a single surge.

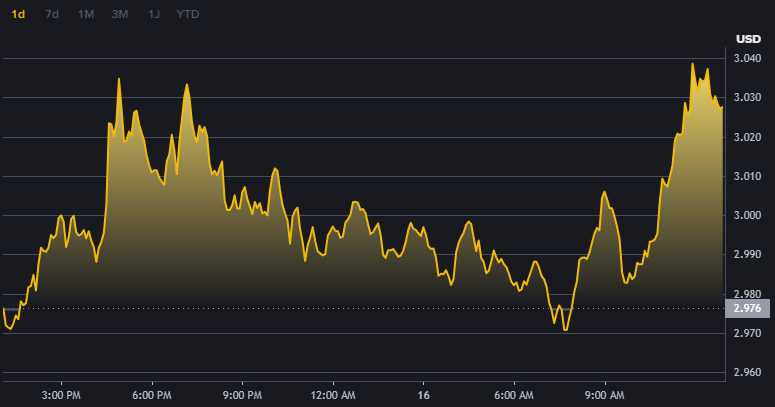

Bitcoin

Bitcoin continues to anchor overall risk appetite across digital assets. Historically, XRP outperformance tends to emerge after Bitcoin establishes strength and then ranges. Therefore, leadership rotation usually starts when Bitcoin’s trend cools.

Several gauges frame that backdrop. Bitcoin dominance, open interest, and funding rates signal when capital rotates into large-cap alternatives. Additionally, healthy breadth across majors improves the odds of sustained XRP follow-through.

Today’s market structure differs from 2017. Liquidity is deeper, and derivatives amplify whipsaws while damping blow-off moves. As a result, fractal overlays can rhyme but rarely replay.

Supportive conditions would look orderly. Bitcoin would hold trend while dominance softens, and leverage metrics would avoid excess. Under those circumstances, XRP’s breakout could progress without sharp reversals.

Adverse conditions would look decisive. If Bitcoin trends hard in either direction, capital usually avoids rotation. Consequently, XRP rallies often stall or retrace until broader conditions improve.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.