- XRP is compressing within a symmetrical triangle, signaling a decisive move as price nears the apex.

- The 25-day and 99-day moving averages at $2.94 and $2.80 provide firm support for the broader uptrend.

- A breakout with rising volume could push XRP toward $3.20–$3.40, while weak volume risks a drop to $2.80.

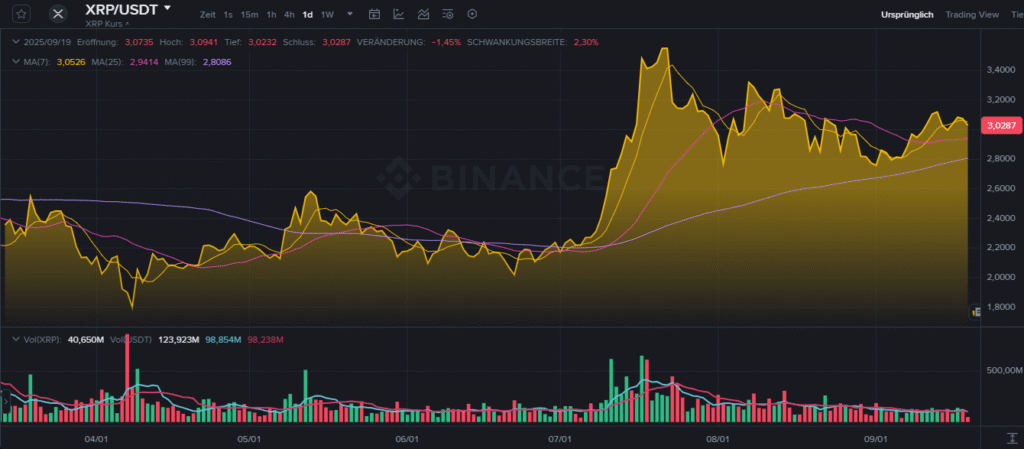

XRP trades near $3.02 while showing signs of compression within a symmetrical triangle pattern on intraday charts. The market displays converging trendlines, which often signal an imminent breakout. Price action now stands at a decisive stage that could define the next short-term direction.

Triangle Breakout Setup

XRP is forming higher lows and lower highs, creating a tightening structure that compresses price into a narrowing range. This pattern indicates indecision, but it also increases the likelihood of a sharp move once a breakout occurs. The apex nears, and momentum is building toward a decisive outcome.

A move above the upper trendline could signal renewed strength, driving XRP toward $3.20 and possibly $3.40. Such a breakout would require confirmation with strong trading volume. However, failure to clear resistance could stall momentum and extend the consolidation.

Alternatively, a breakdown below the lower trendline would accelerate selling pressure, bringing downside targets closer to $2.80 support. Symmetrical triangles often resolve strongly, making the next few sessions critical. The balance between buyers and sellers will soon determine direction.

Market Structure and Outlook

On a broader daily chart, XRP closed at $3.0287 with a daily decline of 1.45 percent. The 7-day moving average sits just above the price at $3.05, while the 25-day and 99-day averages at $2.94 and $2.80 provide firm support. These levels anchor the broader bullish structure despite short-term weakness.

Source: Binance

The coin previously surged beyond $3.40 before retracing and entering consolidation. Since then, the price has fluctuated between $2.80 and $3.20, creating a base for potential breakout attempts. This range continues to define the battle between momentum and resistance.

Volume remains lighter compared to earlier surges, reflecting reduced market participation. However, occasional spikes signal active interest during price swings. If volume expands alongside upward movement, XRP could retest $3.20 and $3.40, while fading demand risks another return to $2.80.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.