- XRP’s next move could hit $3.20 or dip to $2.20, based on technical levels.

- XRP joins Hashdex ETF, signaling growing institutional adoption of crypto.

- XRP Seoul 2025 draws over 3,000 participants, strengthening global community.

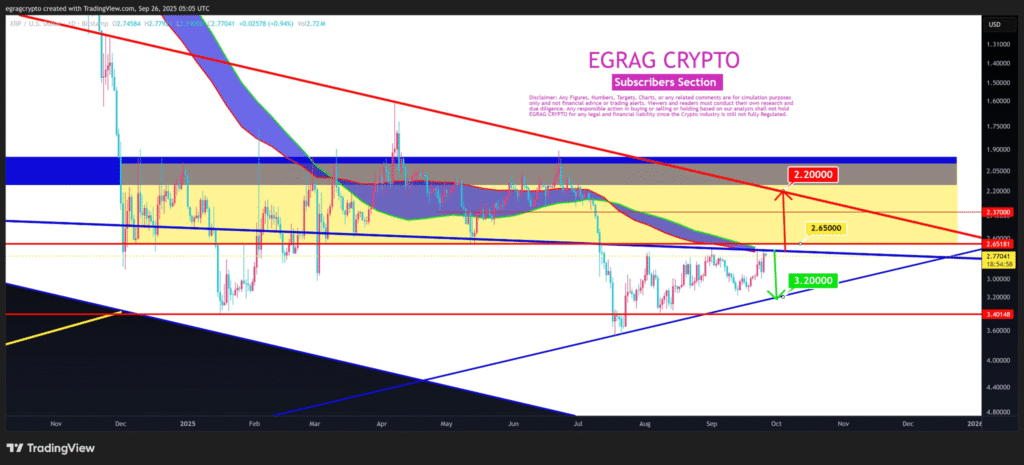

Recent discussions within the crypto community have sparked speculation about XRP’s future price movement. Analysts are divided on whether the cryptocurrency will rise toward $3.20 or drop toward $2.20.

According to a chart shared by Egrag Crypto on Twitter, key resistance and support levels are critical in determining the coin’s direction. If XRP continues its upward trajectory, it may approach $3.20, a crucial resistance level. Conversely, a significant decline could lead to a drop to $2.20.

Egrag Crypto’s analysis highlights technical patterns and trends that could play a role in XRP’s next movement. These levels have generated considerable interest, and many investors are watching closely to see how XRP reacts to these key zones.

Ripple CEO Praises XRP Community at Successful Event

Brad Garlinghouse, CEO of Ripple, recently expressed his appreciation for the global XRP community. He acknowledged their strong presence, particularly after the success of the XRP Seoul 2025 event.

Held with over 3,000 participants from more than 40 countries, the event marked a significant milestone in the development of the XRP and XRPL ecosystems. Garlinghouse congratulated the @XRPSEOUL team for organizing the event and praised the community’s commitment to shaping the future of cryptocurrency.

The gathering provided a platform for discussions and collaboration, reinforcing the sense of unity within the XRP network. Analysts have noted the event’s success in enhancing the global influence of XRP and its ecosystem.

XRP’s Institutional Adoption Through New ETF Listing

XRP’s increasing acceptance in traditional finance was recently highlighted with its inclusion in the Hashdex Crypto Index US ETF. The fund, listed on Nasdaq under the ticker symbol NCIQ, now includes five major cryptocurrencies, including Bitcoin and XRP.

This move follows a change in SEC rules for generic listings, which streamlines the process for cryptocurrencies to be included in ETFs. Analysts view this development as a positive step, reflecting growing institutional interest in cryptocurrencies and the emergence of a clearer regulatory framework.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.