- BONK is consolidating near $0.00002170, a key Fibonacci resistance level that could trigger a bullish breakout if breached.

- The narrowing price range and steady volume indicate compression, often signaling an impending high-volatility move in either direction.

- Sustained stability above $0.0000200 reinforces accumulation behavior and positions BONK for a possible rally toward $0.00003000–$0.00003300.

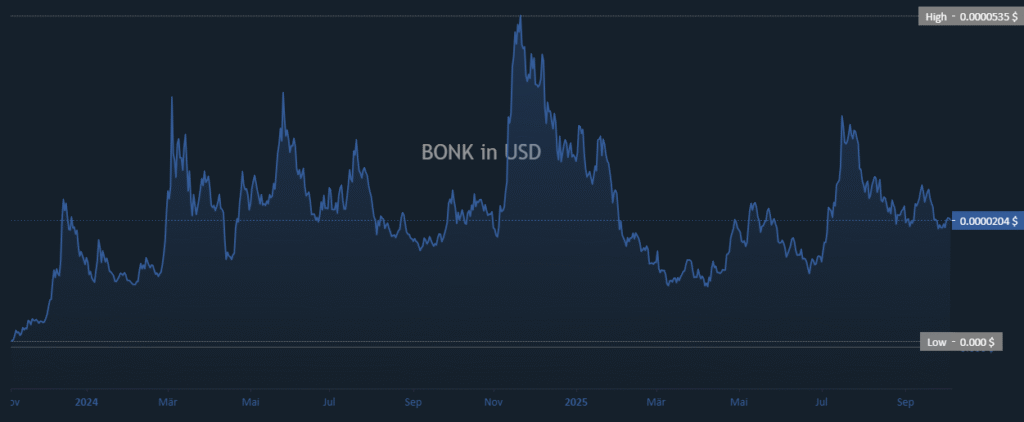

BONK maintained steady price action around $0.0000204 after a period of consolidation, showing signs of potential upward recovery. The meme-based cryptocurrency is positioned near a critical technical zone, where momentum indicators point toward a possible breakout. Current market dynamics suggest the token could retest key Fibonacci resistance levels if upward momentum strengthens in the coming sessions.

BONK’s price has traded between $0.0000150 and $0.0000220 over recent months, reflecting a consolidation phase after earlier volatility. The token is testing a descending resistance trendline, with a breakout target identified around $0.00002170. A confirmed daily close above this point could trigger a shift in market structure, potentially extending gains toward the $0.00003000 region.

The Fibonacci retracement analysis places $0.00002170 near the 0.382 level, marking a crucial pivot for directional bias. Sustained momentum above this range could activate fresh buying interest among technical traders. The pattern aligns with historical rebounds seen during previous accumulation periods, reinforcing the bullish probability.

Market Structure and Momentum

Volume activity remains moderate, suggesting traders are awaiting confirmation before committing to larger positions. The narrowing candle patterns indicate compression, often preceding high volatility moves. A breakout accompanied by higher trading volume would validate the emerging bullish signal and reinforce strength in the trend reversal narrative.

Source: blockchaincenter

However, if BONK fails to close above resistance, consolidation may persist within its current trading corridor. The $0.00001600 level acts as a key support zone, limiting downside risk for now. Holding above this range keeps the market structure intact and preserves BONK’s recovery potential.

Outlook and Broader Context

Historically, BONK has demonstrated repeated price surges followed by steep corrections, characteristic of speculative meme assets. The token remains well below its all-time high of $0.0000535 but is gradually forming a base structure. Sustained price stability near $0.0000200 indicates accumulation and may set the foundation for a new recovery cycle.

A confirmed breakout above $0.00002170 could mark the beginning of a short-term bullish wave targeting $0.000028–$0.000033. Meanwhile, failure to maintain key support levels may result in continued sideways movement. Overall, BONK’s consolidation and strengthening technical posture suggest an imminent directional move that could define its next phase of momentum.