- Monero’s weekly trading volume hit $1.4 billion, the highest this year.

- XMR funding rates turn positive, showing traders favor long positions.

- Analysts expect a possible rally above $347 with targets near $420.

Monero (XMR) continued its recovery on Monday, trading above $314 after rebounding from last week’s support level near $278. On-chain and derivatives data suggest growing optimism among traders. Weekly trading volume has surged to a yearly high, and funding rates have turned positive, signaling renewed bullish momentum.

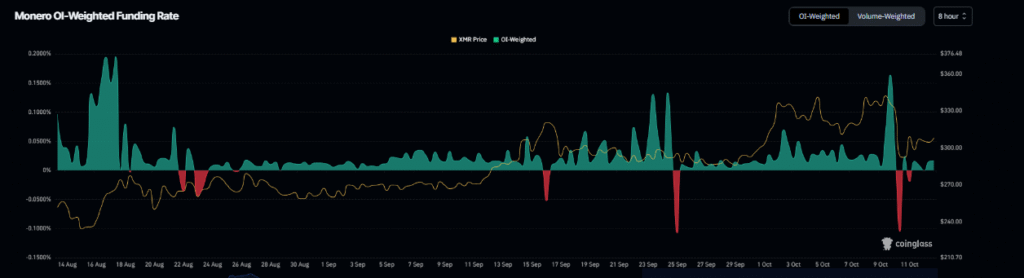

According to Coinglass, the open-interest-weighted funding rate for XMR rose to 0.016%, showing that long traders are paying shorts. Historically, such a shift often precedes strong upward movements.

Market data from Artemis also shows that the weekly trading volume in the Monero ecosystem reached $1.4 billion last week, marking the highest level this year. This increase points to stronger liquidity and higher market participation.

Technical Setup Supports Further Upside Toward $350

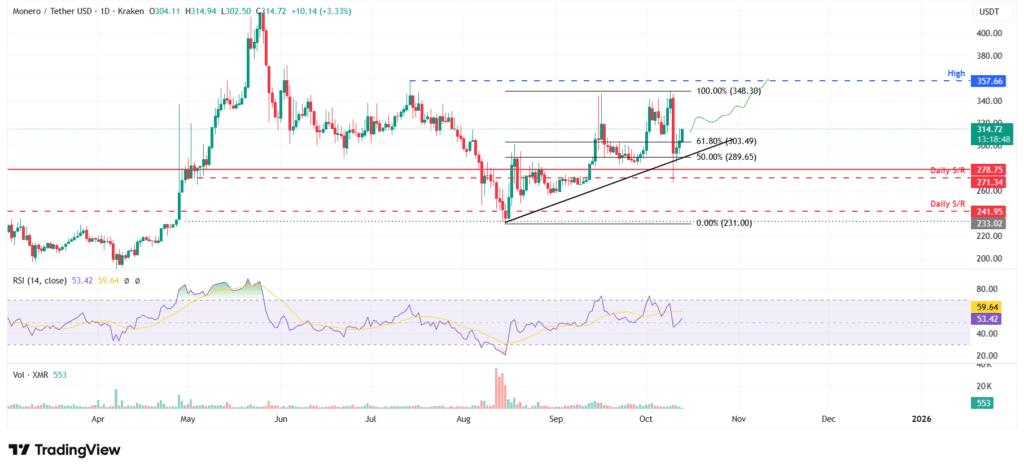

After facing resistance around $348.30, XMR declined by 14% last Friday but quickly found support and rebounded. The price gained nearly 4% over the weekend and rose another 3.3% on Monday, trading above $314.

Technical indicators support a potential continuation of the recovery. The Relative Strength Index (RSI) on the daily chart stands at 53, indicating that momentum is leaning in favor of the bulls. If the upward trend continues, XMR could retest the July high near $357.66.

However, if selling pressure returns, the price may pull back toward the 61.8% Fibonacci retracement level at $303.49. The $285 zone remains an important area of support, according to analyst Crypto Zee, who noted that a move above $320 could open a path toward $347.87 and possibly the $420 level.

Analysts Expect Renewed Breakout Toward $420

At the time of writing, Monero traded at $322.88, up 5.03% in 24 hours, with a market capitalization of $5.96 billion. The daily trading volume of $379.07 million reflects rising investor confidence.

Analysts believe that if Monero sustains momentum above its short-term resistance, it could trigger a bullish crossover between the 50-day and 100-day moving averages. This pattern may pave the way for gains of up to 128%, targeting a breakout near $420.

As trading activity and on-chain signals strengthen, Monero continues to demonstrate growing resilience in the broader cryptocurrency market recovery.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.