- Bitcoin price corrected to $110K after surging to new all-time highs above $126K.

- 172 public companies now hold over 1 million BTC, up 38.7% from last quarter.

- Bitcoin’s price fluctuation follows trade tensions and market volatility, with CME futures lagging behind.

Bitcoin’s price has recently experienced a correction, falling to around $110,000 after reaching an all-time high above $126,000. The price drop followed a rough weekend, during which over $19 billion in leveraged positions were liquidated, forcing more than 1.6 million traders to exit their positions. This price action comes amidst growing corporate interest in Bitcoin, with 172 public companies now holding significant amounts of the cryptocurrency.

Bitcoin Price Trends Lower Amidst Market Volatility

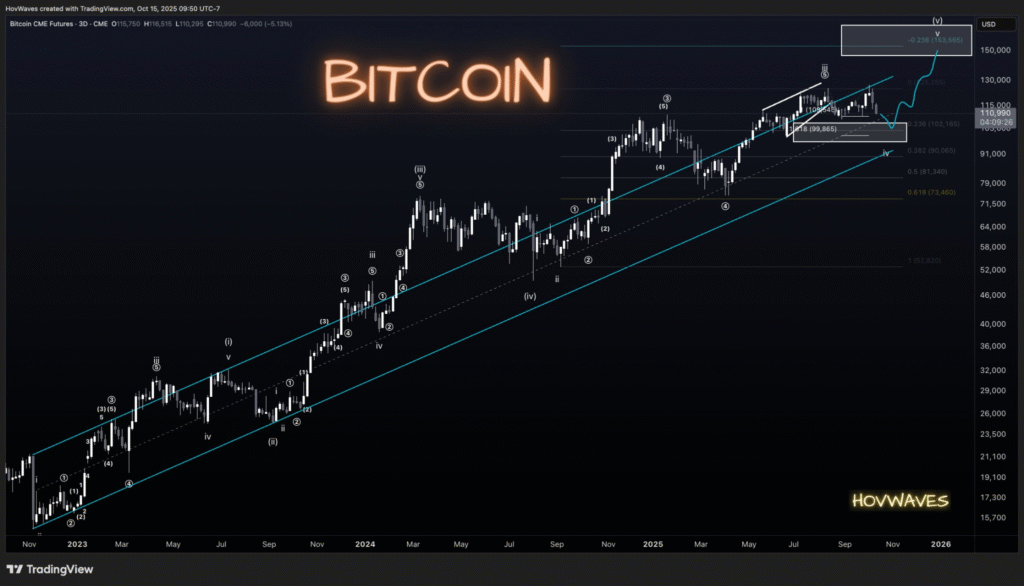

Despite Bitcoin’s dip into the $110,000s, experts remain optimistic about the cryptocurrency’s long-term trajectory. Analysts note that the correction seen in the spot markets is not mirrored on the CME futures chart, which could indicate further downside before Bitcoin starts its next upward movement.

The chart’s behavior suggests that the CME futures market may still target a low point before rallying higher.

The price correction also coincided with global market tensions, especially between the U.S. and China. The announcement of new tariffs on Chinese goods, along with China’s export controls set to take effect in November, sparked uncertainty in global financial markets.

Bitcoin’s price fluctuations have often coincided with such external market pressures, showcasing its role as both a safe-haven asset and a volatile instrument influenced by broader economic events.

Corporate Adoption Reaches New Heights

Corporate adoption of Bitcoin has accelerated significantly in the third quarter of 2025. According to Bitwise Asset Management’s latest report, 172 public companies now hold Bitcoin, a 38.7% increase from the previous quarter.

The total amount of Bitcoin held by these companies has surpassed 1 million BTC, representing nearly 5% of the entire Bitcoin supply. This sharp increase in corporate adoption reflects growing institutional confidence in Bitcoin as a store of value.

With Bitcoin trading at around $114,000 per coin, the holdings of these public companies are now valued at approximately $117 billion, marking a 28% increase from the previous quarter.

The increase in corporate interest is seen as a strong indicator of Bitcoin’s continued acceptance in the financial mainstream. Experts expect corporate adoption to continue rising, contributing to the long-term bullish outlook for Bitcoin.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.