- XRP trades above $2.50 after crowd selling and rising FUD in markets.

- Price must clear $2.59 200-day SMA to confirm the V-shaped recovery.

- Tight Bollinger Bands suggest a strong price move may soon follow.

XRP has climbed above $2.50, showing early signs of a potential V-shaped recovery pattern after weeks of volatile trading. The token’s price movement reflects renewed bullish momentum, though traders remain cautious as it nears a critical resistance zone.

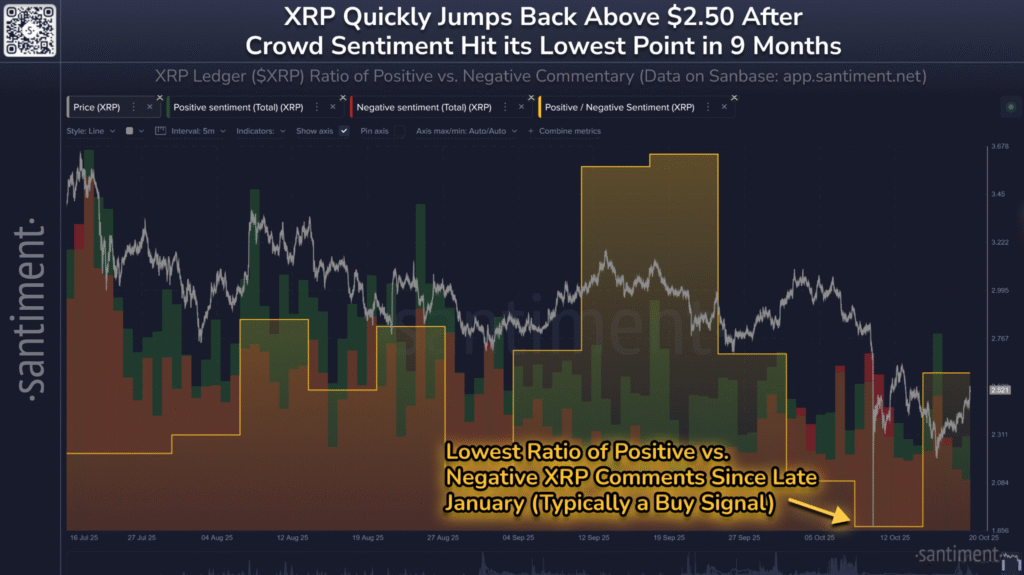

According to Santiment, retail traders have recently been selling XRP at a loss while expressing fear and uncertainty. Market data suggests that prices often move against retail sentiment, adding interest to the current rebound.

Analysts note that XRP’s price trajectory resembles a V-shaped recovery that began forming in mid-September. A V-shaped pattern occurs when an asset sharply rebounds after a steep decline, signaling a possible trend reversal once it breaks through the neckline resistance.

Key Levels to Watch for a Confirmed Recovery

Technical indicators show that the next crucial resistance for XRP lies near $2.59, where the 200-day simple moving average (SMA) is positioned. A close above this level could validate the recovery pattern.

Egrag Crypto, a well-known XRP analyst, stated that “a close above $2.55 to $2.65 on the 3-day time frame would be a strong bullish signal.” If XRP maintains upward momentum, the next supply zone sits between $2.81 and $2.95, bounded by the 50-day and 100-day SMAs.

Should buyers succeed in clearing these barriers, the next target would be the neckline near $3.40. This would mark a 26% rise from current levels, completing the V-shaped recovery pattern seen on the daily chart.

Tight Bollinger Bands Indicate Potential Price Move

Market volatility indicators also point toward a possible large price swing. The Bollinger Band width has tightened to its lowest point since June, a condition that often precedes sharp market movements.

Previously, a similar setup led to a 66% rebound when XRP surged from $2.20 to its multi-year high of $3.66. Traders are now watching the 20-day exponential moving average (EMA) at $2.63, as a sustained break above it could drive XRP closer to the $3.40 neckline target.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.