- Aptos (APT) rebounds 7.84% to $3.56, with massive lower wick signaling altcoin bottom per analyst Michaël van de Poppe.

- Close above $3.60 threshold could unleash green period, targeting $4+ amid 60% recovery from October low.

- Low valuation at $2.56B cap presents rare buy opportunity, bolstered by DeFi growth and stablecoin integrations.

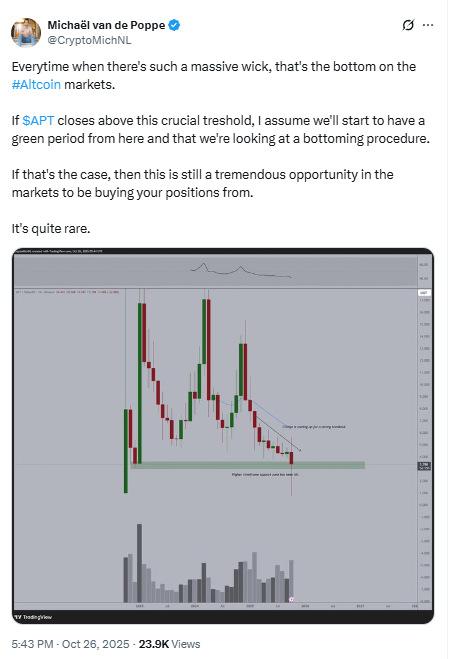

In the trenches of altcoin volatility, few signals scream “buy the dip” louder than a monstrous lower wick on the chart. Aptos (APT), the high-speed Layer 1 contender, just painted one such beast, plunging intraday to test $3.28 before clawing back to close around $3.56—a 7.84% green candle that has traders buzzing. Renowned analyst Michaël van de Poppe nailed it on X: “Everytime when there’s such a massive wick, that’s the bottom on the #Altcoin markets.” If APT seals above this “crucial threshold”—eyeing the $3.60 resistance born from recent highs—we’re staring down a green period, potentially kickstarting a broader altcoin bottoming ritual.

Zooming out, October 2025 has been a bloodbath for alts, with APT shedding over 20% month-to-date amid macro jitters and Bitcoin’s sideways grind. Yet, from its all-time low of $2.22 on October 10, the token’s rebounded 60%, underscoring resilient demand. Van de Poppe’s chart, a TradingView snapshot of hourly bars, spotlights the wick’s rejection at sub-$3.30 supports, with the threshold line slicing through the upper shadows near $3.60. A close above? That’s the green light for bulls, targeting $4.00 and beyond, where Fibonacci extensions align with historical breakouts.

Fundamentals back the hype. Aptos’ Move-based VM continues to lure devs with sub-second finality and 160,000 TPS peaks, powering DeFi hubs like Thala and Liquidswap. TVL has stabilized at $450M post-summer surge, but whispers of institutional inflows—tied to Trump’s WLFI stablecoin eyeing APT rails—could ignite the fuse. Van de Poppe’s been pounding the table: “The markets are providing tremendous opportunities… $APT is one of them, it’s the lowest valuation in years.”

At a market cap of $2.56B, it’s trading at a fraction of Solana’s multiple despite comparable throughput. Risks? Sure—Ethereum’s Dencun upgrades and L2 wars could siphon liquidity, while global rate cut delays cap risk assets. But in a “quite rare” setup like this, as van de Poppe quips, hesitation is the real killer. For cycle vets, this wick isn’t noise; it’s the springboard. Accumulate now, and Q4 could deliver the altseason encore we’ve craved since ’24.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.