- Bitcoin’s short term holder realized price is set near $113,100.

- The next key on-chain support sits around the $88,000 level.

- October saw high volatility with price closing near $106,000.

Bitcoin’s October chart reflected heavy price swings but ended the month nearly flat near $106,000, according to data from TradingView. Daan Crypto Trades noted that despite a new all-time high and the largest liquidation event ever recorded, the monthly performance stayed relatively stable.

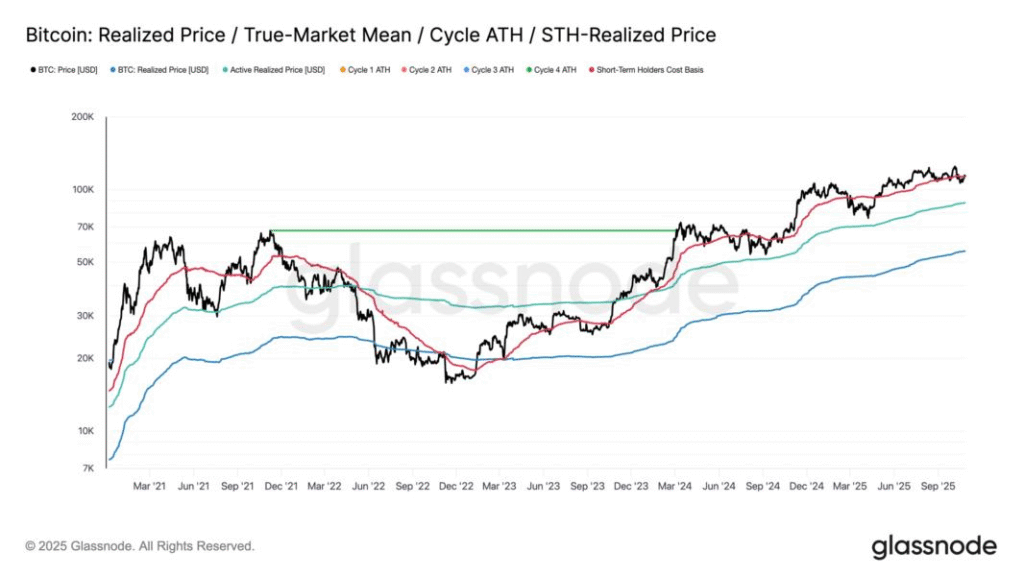

However, the asset is now facing pressure from a key on-chain level. Data from Glassnode shows that Bitcoin has again fallen below its short-term holder (STH) realized price, a zone often viewed as a divider between short-term and long-term market trends.

Short-Term Holders Struggle to Maintain Cost Basis

Glassnode defines the realized price as the average cost basis of all Bitcoin in circulation. When the spot price trades above this level, holders usually remain in profit. When it drops below, it suggests losses dominate.

For short-term holders those who bought within the past 155 days the realized price currently stands around $113,100. Bitcoin briefly reclaimed this level after the early October crash but soon slipped back under it.

“Over the past two weeks, Bitcoin has struggled to close a weekly candle above this key level, raising the risk of further weakness ahead,” Glassnode reported. The repeated failure to sustain movement above $113,100 indicates that recent buyers are once again under pressure.

Key On-Chain Support Lies at $88,000

Glassnode’s data also points to the next major on-chain support level, the active realized price currently near $88,000. This metric excludes long-dormant coins and focuses on Bitcoin that is still actively traded.

If Bitcoin fails to recover above the STH realized price, analysts suggest that traders look toward this $88,000 level for potential support. Despite the broader market’s turbulence, long-term holders appear largely unaffected, as their cost basis remains well below current prices.

As the market enters November, Bitcoin’s ability to reclaim and hold the short-term realized price could determine whether it stabilizes or faces a deeper correction.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.