- VeChain’s (VET) price broke below key Fibonacci and moving average levels, confirming a bearish structure and weakening near-term momentum.

- Binance’s reduction of VET’s collateral ratio to 40% restricted leverage and triggered short-term selling, constraining recovery potential.

- Capital from mid-cap assets, leaving VeChain (VET) exposed to broader market corrections and low volume recovery.

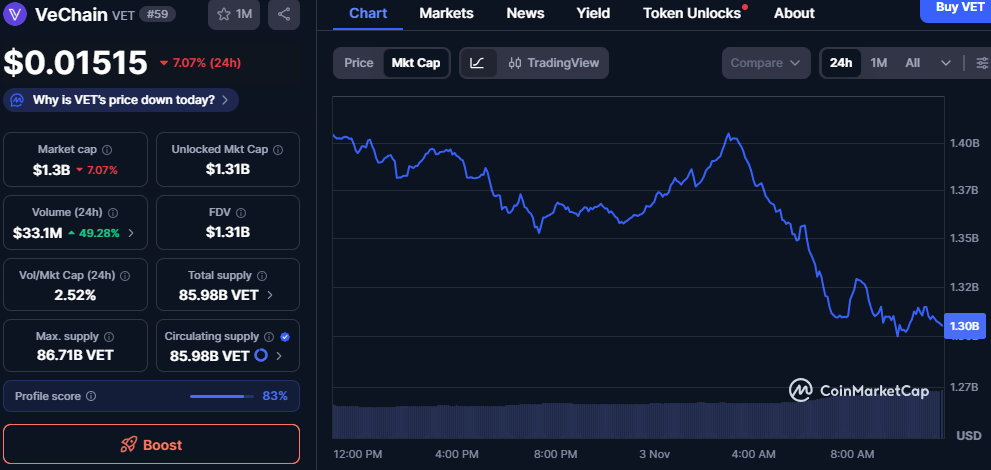

VeChain’s (VET) price slipped 4.63% in the past 24 hours, extending its downward momentum as market sentiment weakened further. The token traded at $0.01515, underperforming the broader crypto market’s 2.38% decline. Despite higher trading volume, VeChain’s (VET) technical signals pointed to sustained bearish momentum across short-term charts.

Technical Pressure Weakens Price Structure

VeChain’s (VET) lost ground after falling below its critical 50% Fibonacci level at $0.0176, signaling increased selling pressure. The token also traded under its 7-day and 30-day moving averages, confirming continued weakness in price momentum. Additionally, RSI at 38.27 and a negative MACD reading suggested deepening bearish conditions.

Source: Coinmarketcap

The breakdown triggered algorithmic selling, pushing VeChain’s (VET) price toward the next support near $0.0139. The structure indicated limited recovery potential unless the token reclaimed the 30-day SMA at $0.0184. Despite minor rebounds, momentum remained weak, with no sustained upward confirmation.

Moreover, short-term indicators continued to flash negative, reflecting uncertainty across intraday trading. VeChain’s (VET) pattern showed limited confidence among traders as liquidity tightened. A decisive close above near-term resistance could shift market bias toward neutral territory.

Margin Cuts and Reduced Leverage Impact

Binance’s margin ratio adjustment from 60% to 40% reduced VeChain’s (VET) leverage capacity, pressuring its liquidity position. The change forced margin users to scale back exposure, creating additional short-term selling across trading pairs. Consequently, VET’s daily trading volume stayed well below its monthly average, signaling reduced participation.

The lower borrowing threshold curbed speculative trading, slowing any potential rebound in VET’s spot markets. Reduced leverage opportunities discouraged aggressive positioning, keeping liquidity conditions tight across exchanges. However, a reversal in leverage policy could gradually restore market depth.

VeChain’s (VET) short-term trajectory now depends on whether trading activity recovers alongside broader altcoin sentiment. Stabilization above $0.016 could improve technical outlooks in the coming sessions. Yet, persistent volume weakness may extend consolidation below key resistance levels.

Altcoin Weakness Extends Market Strain

VeChain’s (VET) downturn aligned with broader weakness across altcoins as Bitcoin dominance climbed to 59.5%. Capital rotation toward Bitcoin and Ethereum drained liquidity from smaller tokens, intensifying downward movement. The Altcoin Season Index’s 60% decline further highlighted weakening sentiment across the sector.

Although VeChain’s (VET) enterprise developments, including Wanchain and StarGate integrations, strengthened long-term fundamentals, short-term sentiment stayed muted. Market participants prioritized stability over growth tokens amid rising volatility. Consequently, positive project updates failed to counterbalance declining liquidity.

In conclusion, VeChain’s (VET) weakness stems from technical breakdowns, reduced leverage access, and fading altcoin momentum. The token’s next challenge lies in reclaiming $0.0184 to reestablish its trend strength. Sustained stability in Bitcoin’s performance may ultimately determine whether VeChain (VET) can recover above $0.016.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.