- Binance stablecoin inflows reach $7.3B, the highest since December 2024

- Similar inflows in 2024 were followed by Bitcoin’s rally from $67K to $108K

- $7.3B entered Binance via stablecoins over 30 days, CryptoQuant data shows

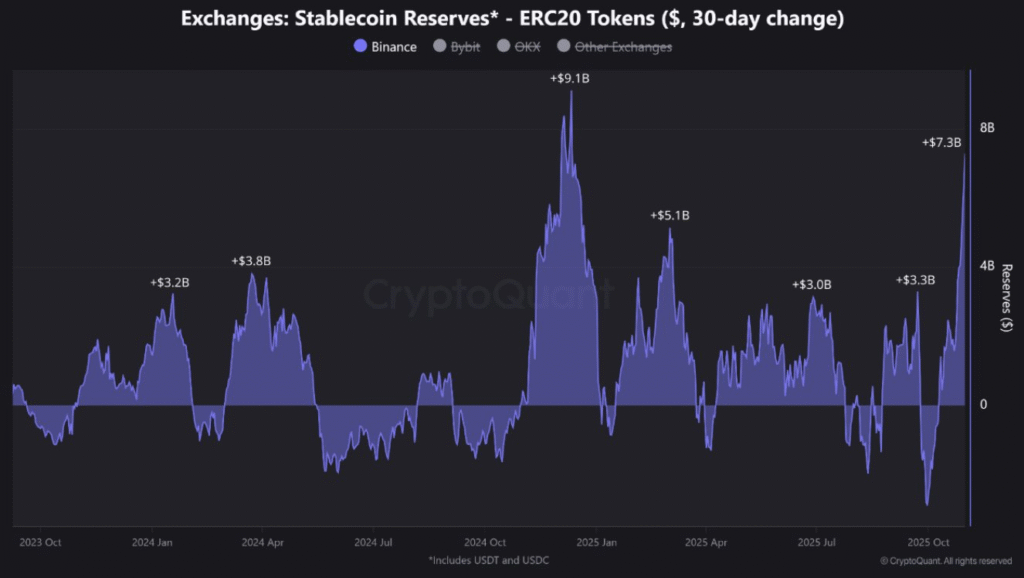

Stablecoin inflows to Binance have reached $7.3 billion in the past 30 days. This level of activity has not been seen since December 2024 a period that preceded Bitcoin’s rally from $67,000 to $108,000..

Stablecoin Inflows to Binance Reach Highest Level Since 2024

Stablecoin inflows to Binance have surged to $7.3 billion over the last 30 days, according to data from CryptoQuant. This is the largest 30-day increase in stablecoin reserves on the exchange since December 2024. At that time, Bitcoin was trading around $67,000 and later rose to $108,000.

The data includes ERC-20 stablecoins, specifically USDT and USDC, held across centralized exchanges. Binance is the largest contributor to this recent spike. Other exchanges such as Bybit, OKX, and others showed smaller movements. This recent inflow has pushed the stablecoin reserve growth figure on Binance to a level not seen in almost a year.

JA Maartun, a CryptoQuant analyst, posted on X: “The last time inflows reached similar levels was in December 2024, shortly before Bitcoin broke its $67K all-time high and rallied to $108K.”

Historical Comparison Draws Attention to Market Trends

The current $7.3 billion inflow is being compared to the December 2024 inflow of $9.1 billion. That earlier surge came ahead of a strong upward move in the price of Bitcoin.

While stablecoin inflows are not direct indicators of price movement, they are often monitored as a sign of potential buying power entering exchanges.

In past cycles, high stablecoin reserves on exchanges have preceded increased trading activity. This data point may reflect higher user interest in crypto markets or preparation for asset accumulation.

However, the source of these stablecoin inflows has not been broken down in the public data. CryptoQuant’s chart shows previous major inflow spikes in early 2024 and mid-2025, but none have matched the scale of this new activity.

The market will likely continue to observe how this trend develops and if it follows historical patterns as seen before the late 2024 Bitcoin rally.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.