- Solana fee share drops from above 50% to 9% as traders rotate chains

- Forward Industries market cap falls below value of its SOL holdings

- SOL price slides 32% in 30 days despite ETF inflows and partnerships

Solana has dropped to around $156, which is near its August lows. The token has fallen as activity has shifted to other chains. Traders have increased their focus on Hyperliquid and BNB Chain, and both chains are seeing strong trading volume.

Solana has also lost market share in Layer-1 transaction fees during this period. Data from DefiLlama shows that Solana’s fee share fell from above 50 percent at the start of the year to about 9 percent now.

Forward Industries, Inc. holds one of the largest corporate Solana treasuries. The firm owns 6.82 million SOL. It bought them at an average price of $232. The holdings are now valued at about $1.2 billion. The unrealized loss is about $382 million.

The company’s stock has also fallen. Its share price dropped 73.6 percent from a $39.6 peak to $10.44. Its $900 million market cap now sits below the value of its SOL holdings.

ETF inflows and major brands join Solana

The network has still recorded major commercial progress. A Solana Staking ETF called BSOL launched on the NYSE. Grayscale started its GSOL trust. SoSoValue data shows more than $280 million flowed into Solana ETFs.

Visa and Shopify continue to connect their services to Solana payments. Western Union also chose Solana for stablecoin remittance rails.

Even so, these events did not push the price higher. The broader crypto market has seen selling pressure, and Solana also moved lower.

Key technical levels and market structure

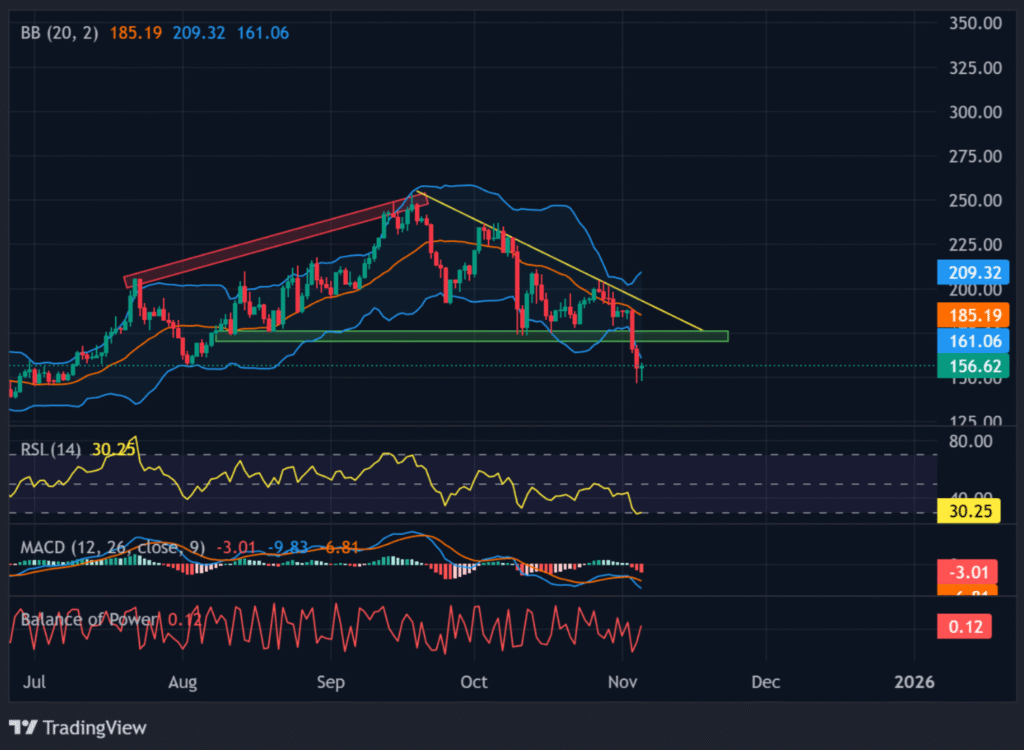

Charts show that Solana trades below a descending trendline and the middle Bollinger Band. The RSI is near 30, which suggests the market is near oversold levels. The MACD remains bearish and sellers still show control.

Analysts say price must close above $185 to $190 to change momentum. If that happens, a move toward $210 to $225 may follow.

If Solana falls below the current zone between $155 and $160, then price could move toward $140 to $130. Buyers are watching these levels while market activity remains weak.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.