- XRP shows bearish trend after breaking key support at $2.5, signaling more potential losses.

- XRP’s price consolidation near $2.1 could indicate potential for recovery despite current market pressures.

- XRP exchange withdrawals mirror a previous accumulation phase, signaling possible recovery ahead.

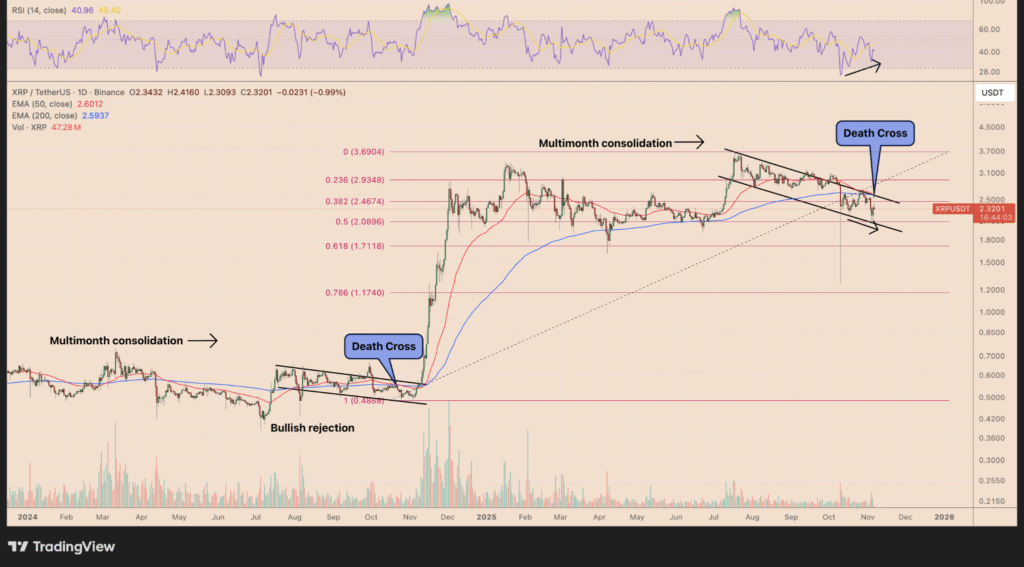

XRP has seen a notable decline, breaking through a key support zone between $2.4 and $2.5. This level had previously acted as a strong floor for the token throughout September and October.

However, sellers have now overtaken this area, causing XRP to struggle and hover around $2.1 to $2.25, where buyers have stepped in to slow further declines. If XRP fails to hold within this range, the next area of significant demand sits around $1.8 to $1.9.

The token’s price dynamics continue to show weakness. The MACD remains flat below zero, with no clear sign of reversal in momentum.

The lack of bullish indicators suggests that XRP’s price remains trapped in a downtrend, with little immediate upside. For any reversal to take place, XRP would need to reclaim $2.5 and close above the 50-day EMA. This would be the first signal of stabilization for the bulls.

Exchange Withdrawals Surge Amid Bearish Price Action

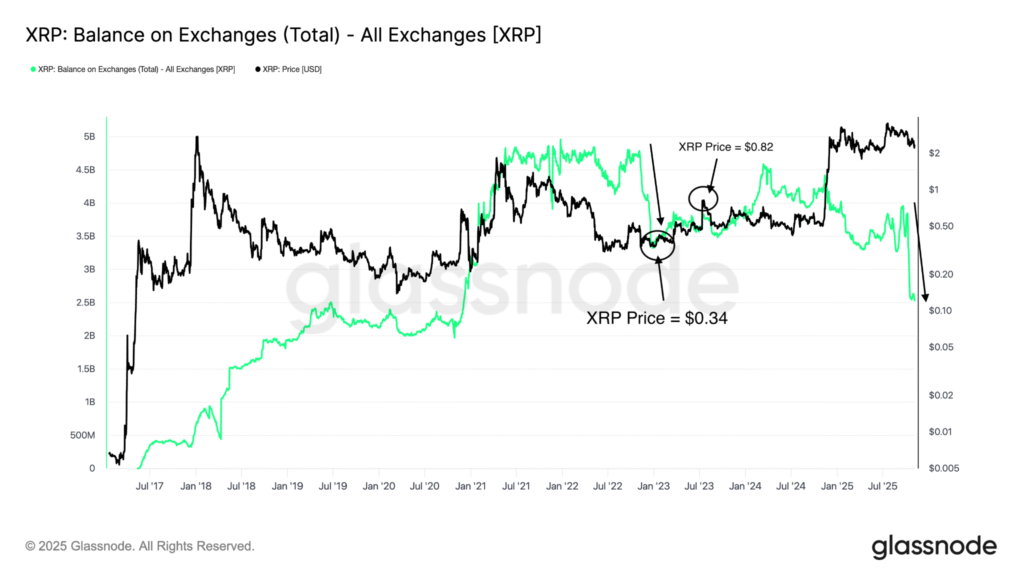

XRP’s performance has also been marked by a significant drop in exchange balances. According to Glassnode data, nearly 1.43 billion XRP tokens have been withdrawn from exchanges since September.

This trend mirrors the historic accumulation phase seen in late 2022, which preceded a strong upward movement in price. The pattern of exchange withdrawals suggests growing investor confidence, with tokens being moved to long-term storage rather than staying on liquid trading platforms.

Despite the bearish price action, this divergence rising withdrawals alongside stagnant prices has been noted as a potentially bullish sign.

Technical Setup Mirrors Previous Price Reversals

The current technical setup for XRP closely mirrors the one seen in late 2024, which led to an explosive rally. Back then, XRP traded within a descending channel marked by a death cross between its 50-day and 200-day EMAs.

Despite initial bearish sentiment, the token broke out of this channel and surged from around $0.48 to $3.69 in a short time.

Today, XRP finds itself in a similar position, forming a descending channel and recently experiencing another death cross. Additionally, the daily RSI is showing mild bullish divergence near the 40 zone, signaling that the downtrend may be running out of steam.

Should XRP manage to break out of this descending channel, it could target the 0.382–0.5 Fibonacci retracement zones, between $2.46 and $2.09. If momentum picks up, XRP could see gains of 25-50%, similar to its recovery last year.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.