- Uniswap proposes activating protocol fees and burning UNI tokens to reduce supply.

- The proposal includes burning 100 million UNI and redirecting sequencer fees to burns.

- Uniswap Labs aims for full governance participation, marking a shift in its strategy.

Uniswap has introduced a proposal to activate protocol fees and implement a UNI token burn mechanism. Adam said the proposal aims to adjust the Uniswap ecosystem’s economic structure, creating a deflationary model for the UNI token.

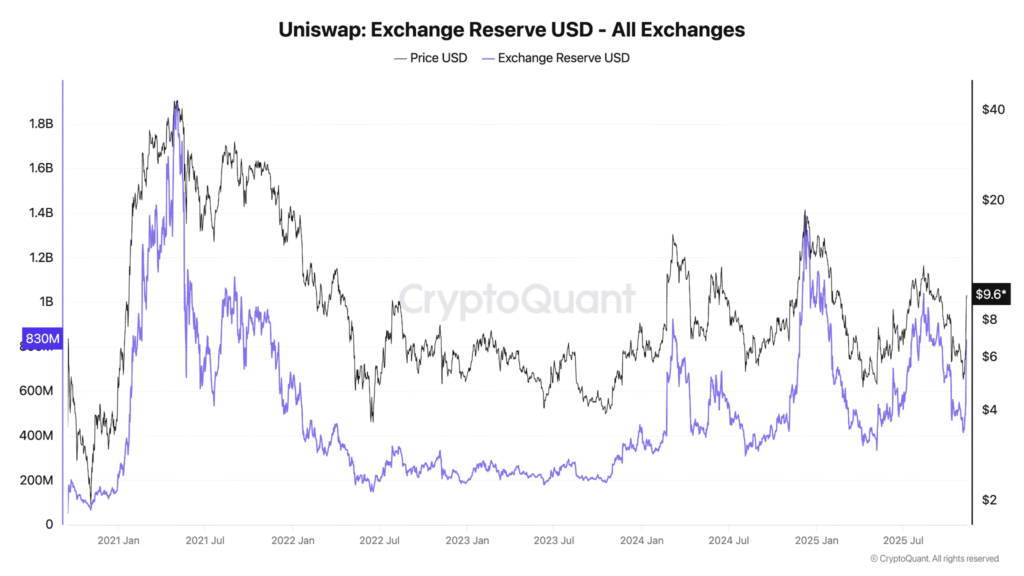

By activating protocol fees on Uniswap v2 and v3, the plan proposes that a portion of the transaction fees will be directed toward burning UNI tokens. This strategic change is expected to reduce the circulating supply of UNI and enhance its value over time.

Protocol Fees and Token Burn

The proposed changes involve the activation of protocol-level fees on Uniswap v2 and v3 pools. For Uniswap v2, liquidity providers (LPs) currently receive a 0.25% fee on each transaction, with a fraction of it allocated to the protocol.

The proposal suggests that a portion of these fees will now be used for UNI token burns. In Uniswap v3, the plan includes utilizing a fraction of LP fees, with either a quarter or one-sixth of the total fees being redirected to burns.

In addition to the protocol fee adjustments, the proposal includes a one-time burn of 100 million UNI from the treasury. This amount represents the tokens that would have been burned if protocol fees had been in place since the inception of Uniswap.

Unichain Integration and Governance Changes

Another significant element of the proposal involves the integration of Unichain’s ecosystem. Launched nine months ago, Unichain has processed significant DEX trading volume. As part of the new proposal, sequencer fees from Unichain will be redirected toward the UNI burn mechanism.

Moreover, Uniswap Labs has pledged to cease collecting fees from its app, wallet, and API. This move is designed to align the interests of the Labs with the broader Uniswap governance structure, focusing efforts on growing the protocol.

To further enhance governance participation, the proposal also outlines the transfer of Uniswap Foundation employees to Uniswap Labs, underlining the commitment to accelerating protocol growth.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.