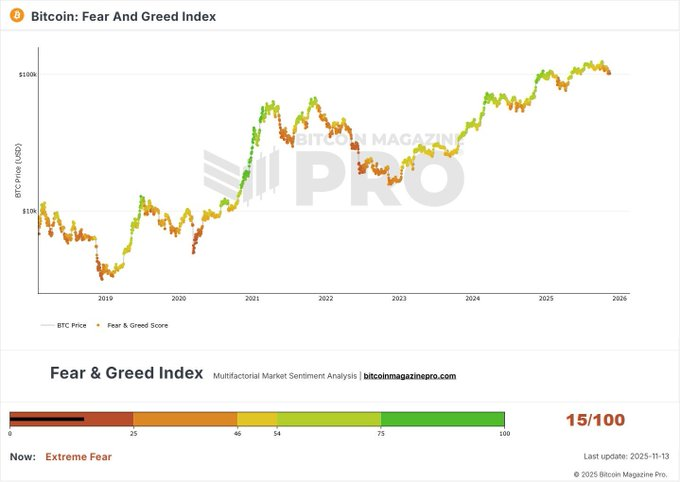

- Bitcoin’s Fear and Greed Index drops to 15, signaling extreme fear.

- Long-term Bitcoin holders continue to sell, following market trends.

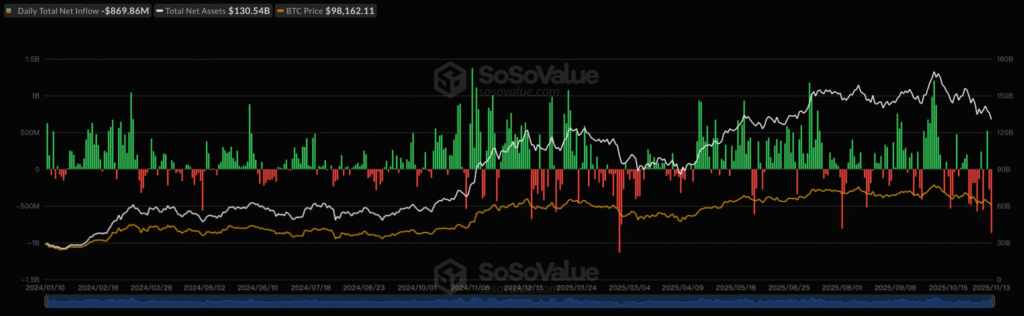

- Bitcoin ETF outflows hit $869.86 million amid market shifts.

The Bitcoin market is currently experiencing extreme fear, as indicated by the Fear and Greed Index. The index has dropped to 15, the lowest since March, which suggests significant pessimism among traders and investors.

This measure tracks market sentiment and indicates how much fear or greed is influencing Bitcoin’s price. Extreme fear often occurs during market downturns, when investors expect further losses and become hesitant to act.

However, despite this extreme fear, Bitcoin’s price continues to show resilience. The long-term trend remains upward, even though short-term sentiment is largely negative. This pattern is not unusual for Bitcoin, as market bottoms often coincide with high levels of fear, followed by recovery once the sentiment improves.

Whale Activity and Market Adjustments

Amid this fearful sentiment, large Bitcoin holders are continuing to adjust their positions. A recent transfer of 2,400 Bitcoin, worth around $237 million, was identified by blockchain platform Arkham.

This transfer was made to Kraken exchange, raising questions about whether major investors are losing confidence in Bitcoin. However, analysts from Glassnode have suggested that this behavior follows typical market patterns.

Glassnode points out that long-term holders have been gradually selling Bitcoin in small, predictable amounts. The analysts describe this as a regular process of profit-taking rather than panic selling.

Bitcoin ETF Withdrawals Signal Market Shifts

Bitcoin’s exchange-traded funds (ETFs) have seen significant outflows, reaching $869.86 million in a single day. This represents the second-largest withdrawal from these products since their launch.

Over the past three weeks, Bitcoin ETFs have experienced a total of $2.64 billion in outflows. These withdrawals reflect a shift in investor sentiment and concerns about the broader market.

Despite these ETF outflows, Bitcoin’s price has remained steady, showing that long-term holders may not be as affected by short-term market shifts. The market sentiment, while fearful at the moment, is not necessarily an indicator of Bitcoin’s future direction.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.