- Chainlink struggles below $15 with potential for recovery if $16 is broken.

- LINK price is testing lower boundary of the downtrend channel with volatility expected.

- Analysts predict a 200% upside to $72 if LINK breaks key resistance levels.

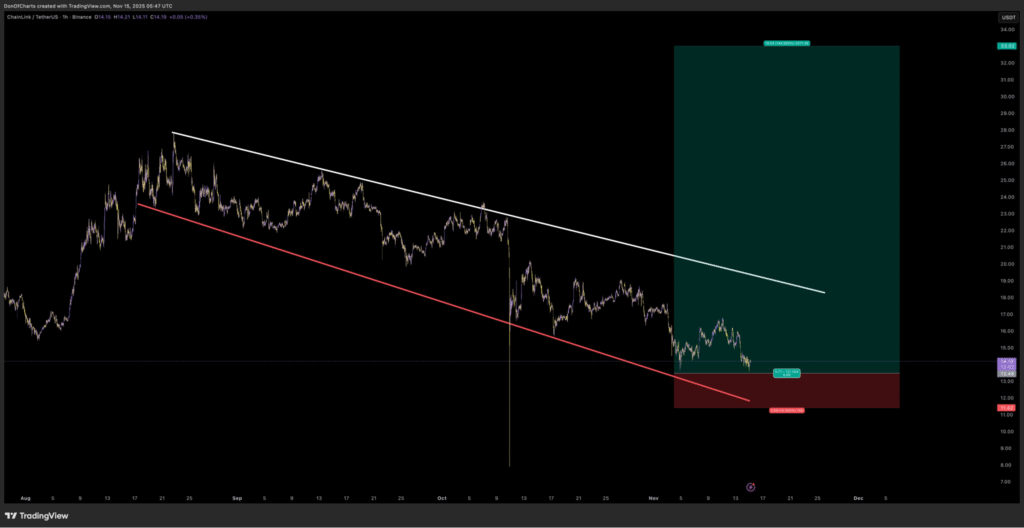

Chainlink (LINK) is currently in a downtrend channel, trading at the lower boundary since August. Analysts have identified this region as a critical level where speculative buyers often enter during extended downturns.

Don, an analyst, highlighted the massive risk-reward potential for LINK if it manages to break above the upper trendline of the channel. This trendline has capped every rally for the past few months. If LINK moves beyond this resistance, early upside targets are between $23 and $30.

However, he stressed the importance of a confirmed breakout before any bullish conviction can be made. If LINK fails to hold the support, downside targets could be near $13 and $12.50.

Bearish Signals Weigh on Short-Term Outlook

Trader CryptoWZRD noted that LINK has struggled to find support below $15.40, a level that has been intraday resistance on multiple occasions. As a result, he believes that the next support levels to watch are $12.50 and $13.50.

WZRD emphasized that LINK must break above $16 for any chance of near-term recovery. Without this move, LINK is likely to remain in a consolidation phase with sideways action until the broader market shows signs of a trend shift. He further cautioned that the ongoing volatility in the market is linked to Bitcoin’s uncertain movement.

Long-Term Patterns Suggest Potential for Significant Gains

James, another analyst, identified a long-term descending triangle on the monthly chart, which has been in place since 2021. He noted that LINK is trading just below the resistance trendline at $15.83, a level that could indicate a breakout and potentially lead to a strong upward move. James forecasts a macro target of $72, based on the height of the triangle.

James’ analysis suggests that if LINK breaks through the $25 to $30 range, it could ignite a bull phase. The accumulation between $10 and $12 over the past two years has created a strong foundation for future price growth.

Once LINK clears resistance between $32 and $36, further price appreciation is possible as momentum traders re-enter the market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.