- Bitcoin falls 10% as the market anticipates rate cuts, boosting hopes for altcoins.

- Fed’s potential rate cut signals impact on Bitcoin’s drop and altcoin outlook.

- Bitcoin’s decline opens opportunities for altcoins if the trend continues.

Bitcoin (BTC) has experienced a notable decline, with its price dropping by 10.11% over the past week. As of now, Bitcoin is trading near $85,071. This price drop comes at a time when market participants are closely monitoring the Federal Reserve’s policy signals.

The odds of a rate cut by the Federal Reserve in December have increased significantly, rising from 39.10% to 69.40% within a day, according to the CME FedWatch Tool.

On Friday, New York Fed President John Williams made comments that contributed to this shift in expectations. Williams stated that the Fed could consider reducing rates “in the near term” without compromising its inflation goals.

This statement, along with other dovish signals, has caused traders to reassess their expectations for the future direction of the cryptocurrency market, particularly Bitcoin.

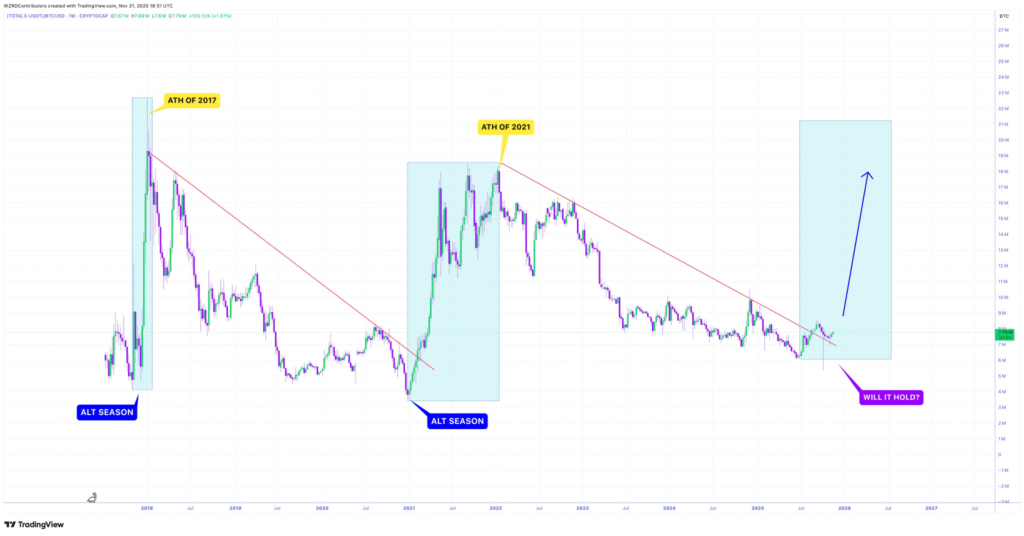

Altcoin Market Set to Rally If Bitcoin Continues Its Downtrend

While Bitcoin’s decline has raised concerns among some investors, it has created an opportunity for altcoins to perform better. A closer look at the total cryptocurrency market, excluding stablecoins (referred to as $TOTAL3), shows that altcoins may see a rally if Bitcoin continues to struggle. The key factor here is the performance of Bitcoin’s dominance, often referred to as BTC.D.

A drop in Bitcoin’s dominance could allow altcoins to capture a larger share of the market. As the Federal Reserve’s policy becomes more dovish and expectations of a rate cut rise, the cryptocurrency market is adjusting.

If Bitcoin continues to show signs of weakness, this could trigger a sharp rally for altcoins, benefiting investors who have placed their bets outside of Bitcoin.

What’s Next for Bitcoin and the Broader Crypto Market?

Bitcoin’s current price movement and the evolving landscape of Federal Reserve policy are key factors influencing the crypto market’s performance in the coming weeks. If the Fed moves forward with a rate cut, it could support a shift in market sentiment, potentially benefiting altcoins.

However, Bitcoin’s performance will remain pivotal for the broader market, as it continues to be the benchmark for most cryptocurrencies.

As the situation evolves, traders will need to watch both Bitcoin’s price action and the Fed’s decisions closely. Should Bitcoin continue its downward trend, altcoins could receive the boost many investors have been waiting for. However, any change in Bitcoin’s trajectory could shift the market dynamics once again.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.