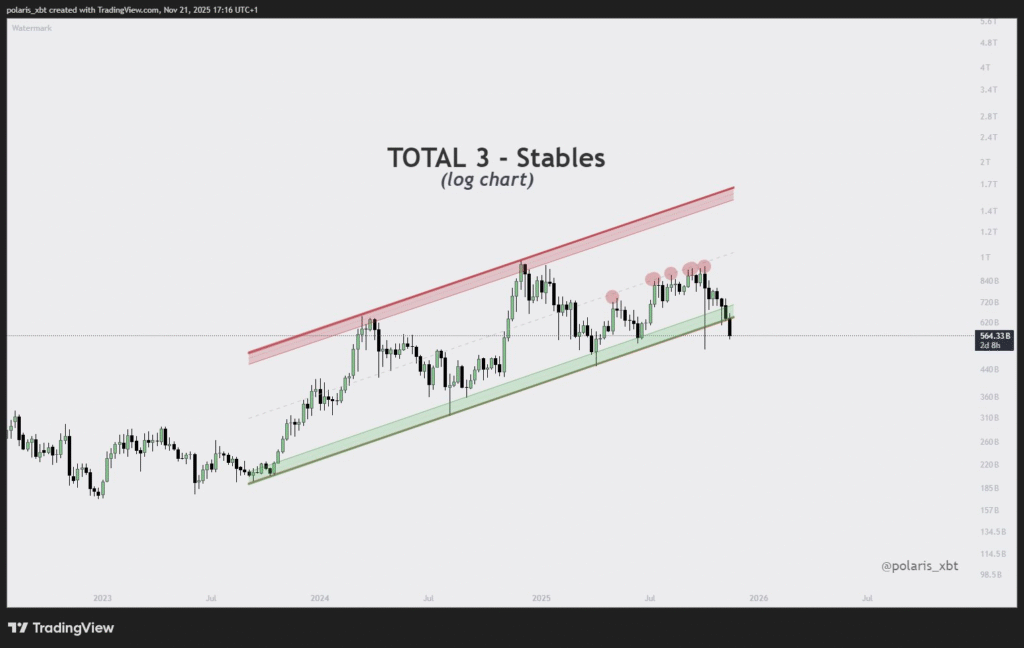

- Altcoin market fell below a two-year log trend with a current cap of $564.33B.

- Sentiment peaked in December 2024 and now mirrors past market bottoms.

- Ethereum ETF was approved, but broader altcoin ETFs show mixed traction.

The altcoin market has dropped below a two-year log channel for the first time since mid-2023. This move follows a period of fading momentum and comes just as new altcoin ETFs begin trading in traditional markets.

Two-Year Log Channel Break Signals Weakness

According to polaris_xbt, the total altcoin market has fallen below a key log trend channel that supported price action for two years. This structure, shown in the “TOTAL 3 – Stables” chart, started in mid-2023 and remained intact until November 2025. The recent break signals that momentum has shifted.

The market peaked in December 2024 and has since declined. The current value of the altcoin market is $564.33 billion. This level is close to previous bear market lows, and it reflects a slowdown in investor demand despite structural market developments. The channel break also follows repeated failures to move past the upper resistance zone throughout 2025.

ETFs Arrive But Response Remains Mixed

New altcoin-focused ETFs were launched recently, beginning with Ethereum. These products allow traditional investors to gain exposure to crypto without holding tokens. While this move was expected to bring new capital, the results so far are uneven.

Ethereum gained ETF approval first, and other major altcoins followed. The response in market prices has varied, with no clear upward momentum yet. This shows that ETF launches do not always lead to immediate inflows. One observer noted, “Altcoin ETFs have arrived, and one wonders whether Wall Street just started an altseason without meaning to.”

Sentiment Resembles Previous Cycle Lows

Sentiment across altcoin markets is currently similar to levels seen during prior market bottoms. Traders note that resistance near the $1 trillion mark was tested several times, but failed. These repeated rejections caused selling pressure to increase, eventually pushing prices below the lower boundary of the channel.

Technical analysts see this as a key break. However, some suggest a recovery could still happen if Ethereum gains strength again. Ethereum often leads price moves in altcoins, and its performance may influence market direction in the short term.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.