- Bitcoin fell 3.35% in 24 hours to $85,810 after failing support at $90,000.

- Trading volume dropped nearly 20%, now at $43.58 billion in 24 hours.

- Spot ETF gains show after-hours strength but intraday losses since launch.

Bitcoin has dropped to $85,810 after failing to hold support above $90,000. The price declined steadily over the past 24 hours amid corrections in global markets, including gold and tech stocks. Economic events such as U.S. CPI, unemployment data, and a possible rate hike from the Bank of Japan are adding pressure to crypto and equities alike.

Price Drops as Support Breaks and Volume Declines

Bitcoin is now priced at $85,810, down 3.35% in the last 24 hours. The asset lost support at $90,000 and continued declining during U.S. trading hours. The daily trading chart shows a sharp move down beginning in the early evening, with stabilization overnight.

Market volume also declined by 19.92%, with total volume at $43.58 billion. Bitcoin’s market cap stands at $1.71 trillion, while the total supply remains near its limit at 21 million BTC. The volume-to-market-cap ratio is now 2.59%, reflecting lower trading activity compared to value.

Traders Monitor U.S. and Japan Data This Week

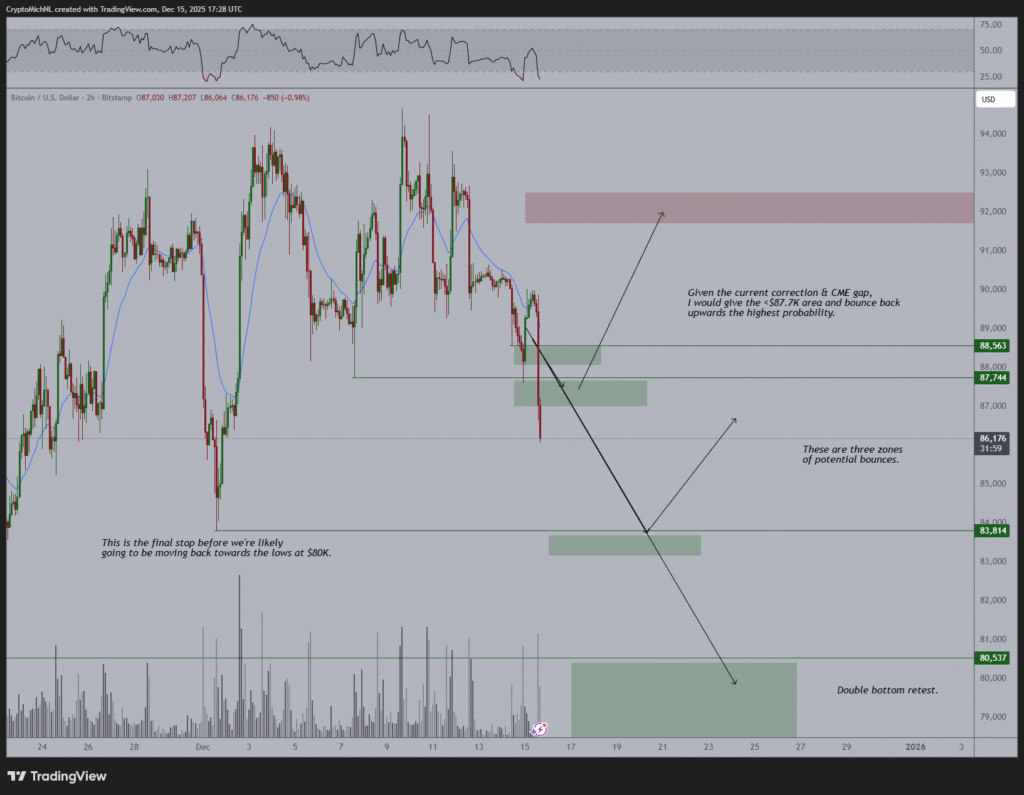

However, macroeconomic events expected this week include U.S. unemployment data, consumer price index updates, and an expected decision by the Bank of Japan. Analyst Michaël van de Poppe said, “With this breakdown, I’m looking at levels at <$83.8K and most likely <$80.5K.”

He also mentioned that previous rate hikes in Japan were followed by price declines, suggesting that current market weakness could be in anticipation of this event. A move back above $88,000 could be an early sign of recovery, but current market action remains cautious.

ETF Performance and Investor Behavior Raise Questions

Performance of the iShares Bitcoin ETF (IBIT) shows a stark contrast between intraday and after-hours trading. Bespoke Investment noted on X, “Had you only owned [IBIT] intraday, it’s down 40.5%. After hours, it’s up 222%.”

This trend has raised attention to weak intraday demand, particularly during U.S. market hours. Bitcoin’s relative underperformance during the day may reflect institutional caution or structural behavior linked to ETF mechanics.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.