- XRP broke above the 0.5 Fib level at $1.88 and now trades near $1.91.

- RSI is above 60, showing upward momentum as price approaches resistance.

- If $1.88 is confirmed as support, a rally to $2.30 may follow soon.

XRP has regained a critical support level at $1.88, as traders await a possible confirmation. If the price holds, it expects a strong upward move toward the $2.30 resistance level. This sets the stage for a possible breakout at the start of the year.

XRP Holds Above $1.88 Fibonacci Support Level

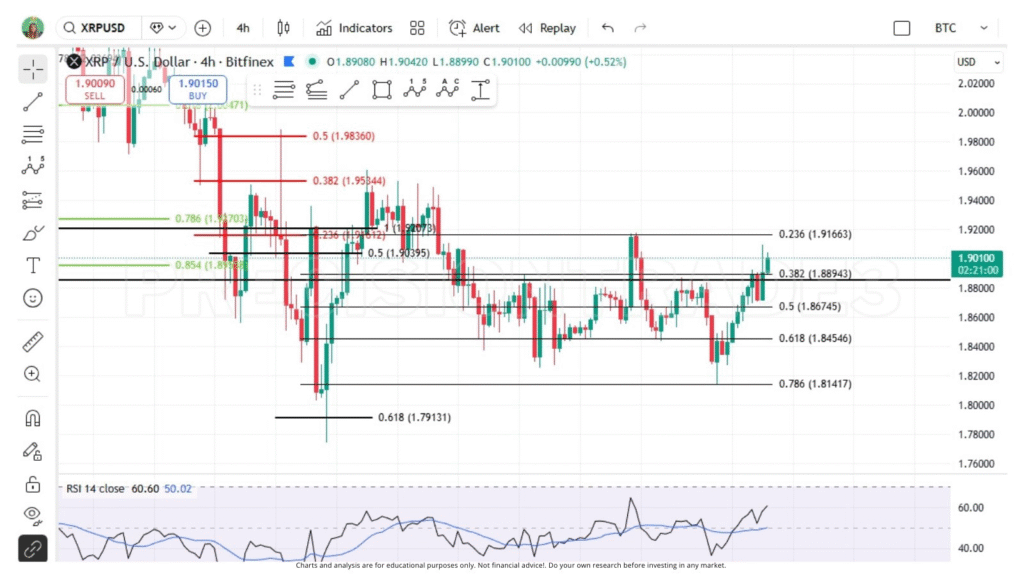

XRP/USD has climbed above the 0.5 Fibonacci retracement level near $1.88 on the 4-hour Bitfinex chart. The asset showed renewed buying interest at the start of the year, briefly testing resistance near $1.916.

However, if XRP can confirm $1.88 as a new support base, technical analysis suggests this level holds historical importance. The Fibonacci tool marks it as a midpoint from the previous swing low to high.

Price action on the chart reveals XRP recovered from a low of $1.7931, aligning with the 0.618 Fibonacci level. The RSI indicator is also above 60, signalling positive momentum. XRP must now consolidate above the $1.88 mark to confirm a bullish setup.

Traders Eye $2.30 if $1.88 Support Holds

A strong support retest around $1.88 could provide the base for the next leg upward. If XRP holds this level, the next resistance to watch is at $1.916, followed by $2.30. The $2.30 level has acted as a major resistance point in past rallies.

Analyst PrecisionTrade3 commented, “We need XRP to come down to $1.88 again and confirm it as support.” A backtest of this level may happen soon based on the current price behaviour.

The current structure shows several Fibonacci levels aligning with local highs and lows. These include 0.382 at $1.8845, 0.618 at $1.8546, and 0.786 at $1.8414. As long as XRP stays above $1.88, the bullish outlook remains valid in the short term.

The market is also awaiting confirmation through RSI movement and price behaviour around the key resistance zone. If broken, $2.30 may come into play quickly, supported by market momentum.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.