- Bitcoin’s bear market is expected to hit $40k by October 2026.

- Bitcoin’s price could peak between $172k and $203k by September 2029.

- A potential rally may push Bitcoin beyond $90k due to liquidity.

Bitcoin’s price movements are forming a recognizable pattern, according to the macro chart analysis from CryptoBullet. Based on Fibonacci retracement levels, the analysis suggests that Bitcoin will hit its bear market bottom at around $40,000 in October 2026.

Following this bottom, Bitcoin is expected to enter a new bull cycle, with a projected top reaching between $172,000 and $203,000 by September 2029.

The chart also shows that Bitcoin’s price has already peaked within the $100,000 to $130,000 range during previous cycles. These cycles, identified by specific Fibonacci levels, are being used to predict future price action.

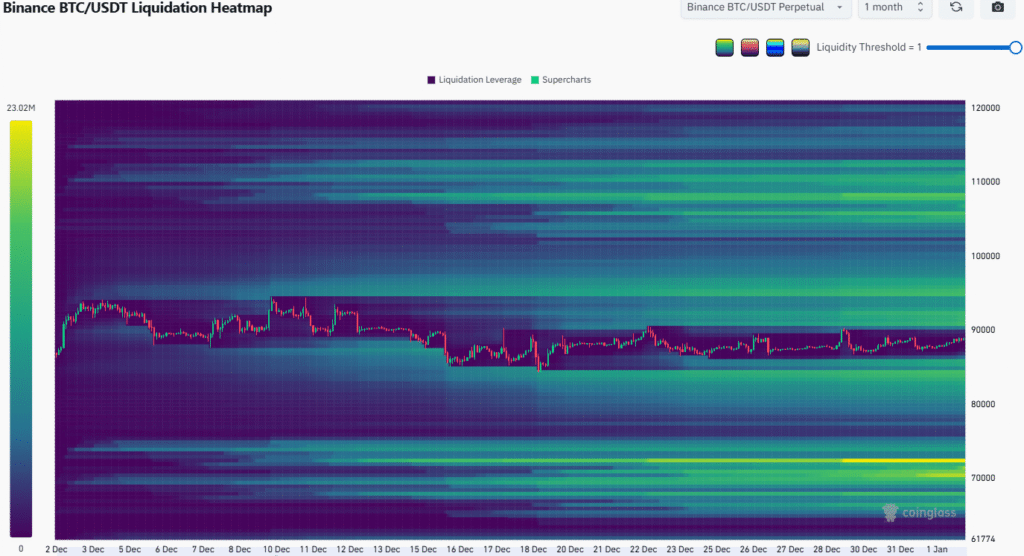

Liquidity and Short Liquidation May Push Bitcoin Beyond $90k

Liquidity is a key factor influencing Bitcoin’s price in the short term. The Bitcoin liquidation heatmap, based on data from CoinGlass, shows that there is a significant cluster of short liquidations between $91,000 and $96,400.

These liquidations could create upward pressure on Bitcoin’s price, potentially leading to a short-term rally.

This rally could push Bitcoin beyond $96,000 if it triggers a cascade of short liquidations. However, as the rally is driven by the derivatives market, it may be followed by a price retrace.

Bitcoin’s Long-Term Projections Suggest a Strong Future

CryptoBullet’s analysis also highlights that Bitcoin’s future cycles are closely tied to historical patterns. As Bitcoin stabilizes after its bear market low, the possibility of reaching new all-time highs increases.

If past behaviour holds, the asset will once again make significant strides toward new highs, potentially surpassing the $200,000 mark by 2029.

Bitcoin may be headed, considering both short-term volatility and long-term trends. The expected movement around the $40k support zone in 2026 sets the stage for a new bullish phase, with prices potentially skyrocketing toward $172,000–$203,000 in the years ahead.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.