- ETHBTC breaks long-held 0.032 level for the first time in months.

- Whale with $700M ETH long position liquidated, losing $110M PnL.

- ETHBTC now trades between 0.026 and 0.03, with high sell volume.

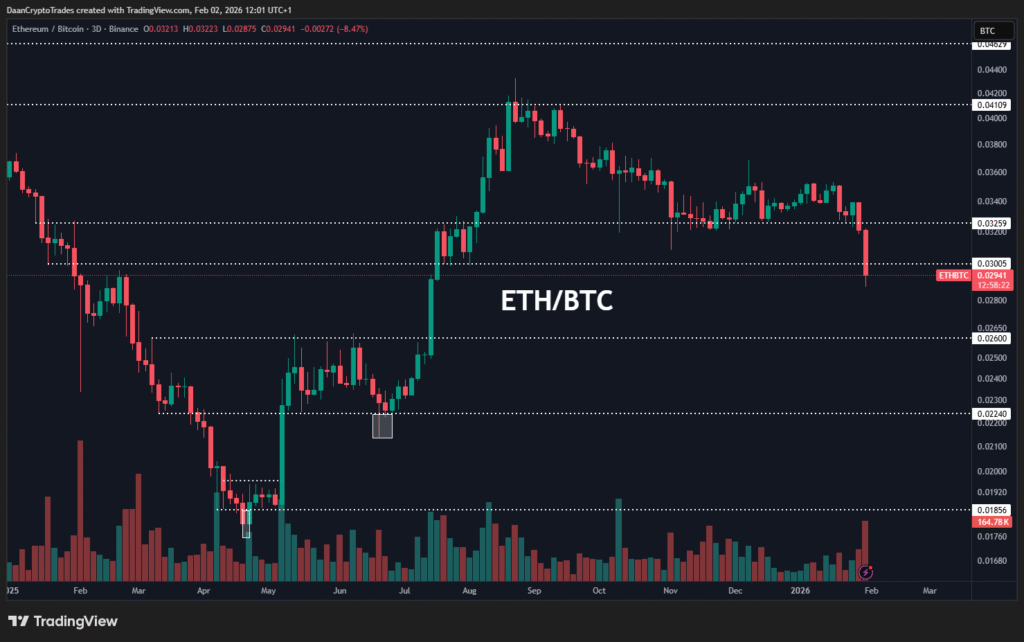

Ethereum’s trading pair against Bitcoin (ETH/BTC) has broken below its long-standing 0.032 support level for the first time in months. The drop followed a major whale liquidation, where a $700 million long position was wiped out, resulting in a $110 million loss and triggering sharp volume spikes across the market.

ETHBTC Breaks Support as Whale Liquidation Hits the Market

The Ethereum to Bitcoin trading pair (ETH/BTC) fell below its long-standing support at 0.032 BTC this weekend. Daan Crypto Trades analysis shows ETHBTC declined by more than 8%, closing at 0.02941. The breakdown ended weeks of range-bound price action above the 0.032 level.

Traders have pointed to a large forced liquidation as a major reason for the drop. A whale with a long position valued near $700 million was reportedly liquidated. This trader suffered a $110 million loss in unrealized profit in a single day, based on public data from crypto platforms tracking large positions.

The support break led to a sharp increase in sell volume, as seen in the volume bars on the chart. ETHBTC is now trading between 0.026 and 0.03 BTC, which analysts describe as the next key range to monitor. Price action within this zone may define Ethereum’s short-term strength relative to Bitcoin.

Volume Surges as ETHBTC Moves Into Lower Trading Range

Market activity accelerated as the ETHBTC pair fell below the key support. The breakdown came with a visible surge in trading volume, reflecting market reaction to the whale liquidation. Such moves often trigger cascading liquidations or panic selling from other traders with similar positions.

According to Daan Crypto Trades, “ETH had been holding on to that 0.032 level against BTC for a long time but the floor did finally fall through.” The liquidation event, combined with broader market pressure, appears to have tipped the balance.

The trading range between 0.026 and 0.03 BTC now becomes critical. Price stability within this range will be essential for any recovery. If Ethereum weakens further against Bitcoin, it could affect broader altcoin sentiment as well.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.