- Crypto markets peaked in December 2024 and may be bottoming now

- Analyst links Bitcoin strength to volatility drop in gold and silver

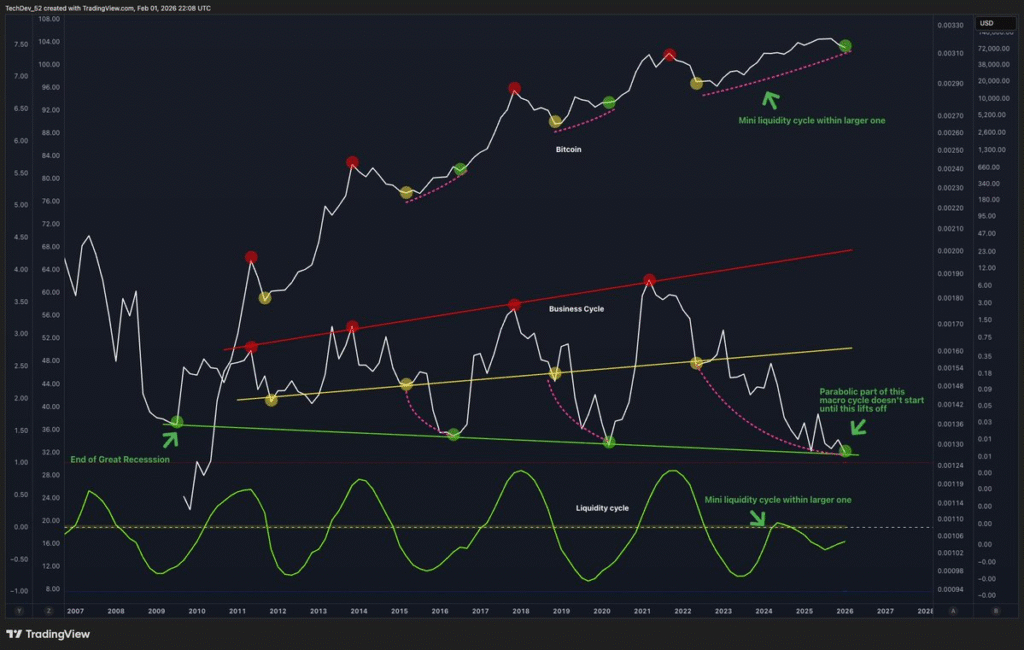

- Business and liquidity cycles show past pattern near turning points

Crypto market conditions may be shifting as liquidity and business cycles reach historical turning points. According to analyst Michaël van de Poppe, these macro signals suggest the market bottom may be forming, setting the stage for a potential rally led by Bitcoin and altcoins.

Crypto Cycles Align With Market Bottom as Analyst Eyes Recovery

Crypto analyst Michaël van de Poppe believes the markets are bottoming out in early 2026 after a peak in December 2024. According to a shared macro chart, both business and liquidity cycles are approaching levels that have historically triggered bull runs in Bitcoin and altcoins.

Van de Poppe pointed to the unusually long bear market as part of the macroeconomic stress. He noted that crypto is now treated as a high-risk asset, making it more sensitive to broader financial market conditions. “The markets are bottoming during this month,” he stated, adding that past cycle patterns are repeating.

Macro Trends May Redirect Capital Back Toward Bitcoin

In his analysis, van de Poppe said capital has recently shifted into gold and silver due to rising volatility and risk balancing. Asset managers, he explained, were forced to de-risk by moving out of crypto during this period of uncertainty.

He added that declining volatility in gold and silver could lead to renewed interest in Bitcoin. “Once volatility goes down on Gold and Silver, that’s the moment the allocations are going to be pushed more towards Bitcoin,” he noted. Lower yields, falling interest rates, and weak economic data may further support this shift.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.