- MANTA trades near lower boundary of descending channel indicating potential reversal.

- Analyst projects up to 500% profit if breakout occurs above resistance.

- Captain Faibik signals increased accumulation as price nears key support.

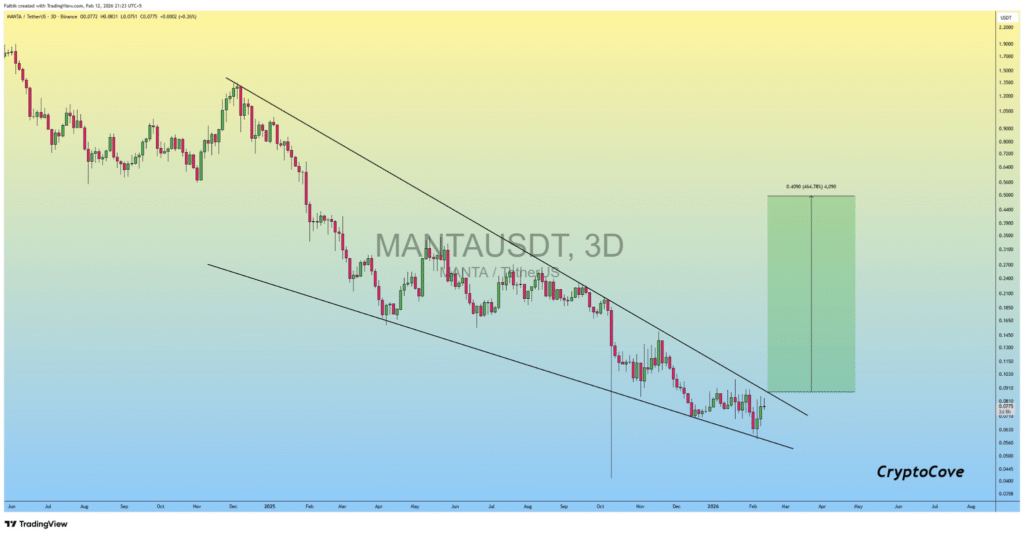

MANTA is showing early signs of a potential rebound as price tests the lower boundary of a descending channel. Traders are watching closely for a possible breakout that could trigger significant upside. Analyst Captain Faibik has highlighted this area as a favorable accumulation zone with high-risk, high-reward potential.

MANTA Trades Near Lower Boundary of Descending Channel

Crypto analyst Captain Faibik shared a technical update on MANTA, noting that the asset is currently trading near the lower boundary of a descending channel. The three-day MANTA/USDT chart shows price moving within this structure, marked by consistent lower highs and lower lows.

The descending channel represents a prolonged bearish phase, and testing the lower boundary often attracts buyers looking for potential reversal opportunities. Faibik stated, “I am adding more $MANTA,” highlighting the current accumulation strategy. Traders typically monitor this level for a possible shift in momentum.

Recent candlestick patterns suggest that selling pressure may be easing as MANTA approaches channel support. Analysts note that patience is crucial, as confirmation of upward movement is needed before entering positions.

Upside Potential and Accumulation Strategy for MANTA

The analysis indicates that a breakout above the descending channel could trigger a significant recovery move. Faibik projects potential gains of up to 500% if momentum accelerates and higher resistance levels are tested.

Investors are advised to observe volume levels alongside price action. Technical indicators show that accumulation near the channel floor could increase buying pressure, creating a high-risk, high-reward setup. Faibik emphasized that careful monitoring of MANTA is necessary, as breakout confirmation may set the stage for a substantial rally.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.